Tradeweb Government Bond Update – October 2024

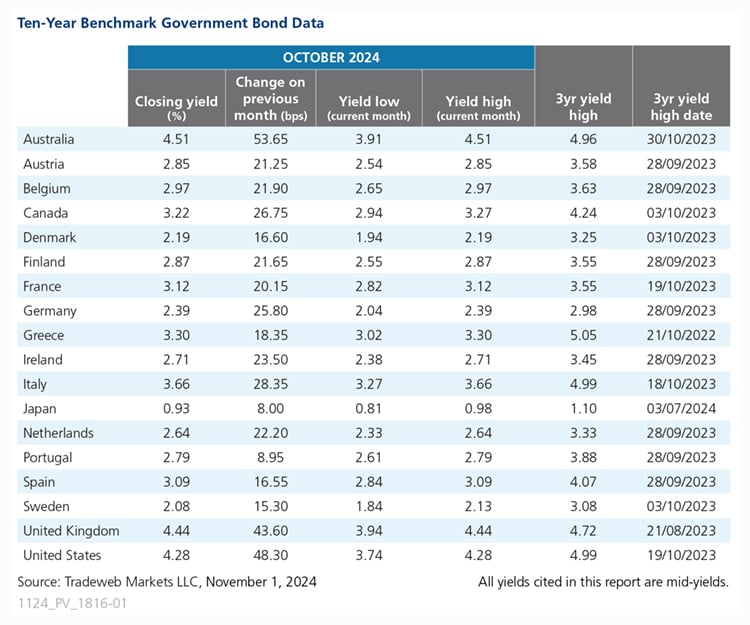

October saw a sell-off in global government debt markets, with yields on 10-year benchmark notes increasing across the board. The month’s biggest mover was the Australian 10-year government bond, whose mid-yield rose by 54 basis points to 4.51% from 3.97% in September. The Westpac Melbourne Institute Consumer Sentiment Index rose 6.2% to 89.8 in October from 84.6 the month prior. The country’s headline inflation in the third quarter of this year sank to 2.8%, the lowest level since the first quarter of 2021.

Staying in Asia Pacific, Japan’s 10-year government bond yield ended the month at 0.93%, an increase of 8 basis points from September’s figure. In October, following an early parliamentary election, the ruling Liberal Democratic Party (LDP) and Komeito missed out on the required 233 seats for a majority in the lower house. The Bank of Japan voted to hold interest rates once again at 0.25% on October 31, while the country’s annual inflation rate fell to 2.5% in September from 3% in the prior month, marking the lowest reading since April.

Europe’s biggest mover was the UK 10-year Gilt yield, which finished at 4.44%, a 43-basis point rise from 4.01% in the previous month. On October 30, Rachel Reeves delivered her first Autumn Budget as the Chancellor of the Exchequer, unveiling plans to raise approximately GBP 40 billion to support government programmes. The GfK Consumer Confidence indicator fell one point to -21 in October from -20 in September, while the S&P Global UK Manufacturing PMI eased to 50.3 in the same month, down slightly from 51.5.

Meanwhile in the Eurozone, the European Central Bank on October 17 cut its key interest rate to 3.25%, the third quarter-percentage-point reduction of the year. The German 10-year Bund mid-yield rose by 26 basis points in October to 2.39%. According to preliminary readings, the country’s annual inflation rate surged to 2.4% in October from 1.8% in September, back above the European Central Bank’s target of 2%. The HCOB Germany Manufacturing PMI increased to 42.6 from the 12-month low of 40.6 in the previous month.

The Italian 10-year benchmark note mid-yield registered at 3.66% at month-end, a 28-basis point increase since September. The country’s preliminary inflation estimate by Istat revealed that headline inflation rose marginally in October, reaching 0.9% from 0.7% in September. In France, the mid-yield on the country’s 10-year government bond jumped 20 basis points to close October at 3.12%. France’s annual inflation rate edged up to 1.2% in October from 1.1% in September, which was the lowest level since March 2021.

Across the Atlantic, the U.S. 10-year Treasury mid-yield saw an increase of 48 basis points in October to 4.28%. The country’s jobs report in the same month showed nonfarm payrolls increased by just 12,000, down sharply from September’s 223,000, according to the Bureau of Labor Statistics. At the same time, the Federal Reserve’s preferred measure of underlying inflation, the personal consumption expenditures (PCE) price index, rose by 0.2% in September, after a gain of 0.1% the previous month.

In neighbouring Canada, the 10-year government bond yield jumped 27 basis points to 3.22% at month-end. On October 23, the Bank of Canada reduced its key benchmark rate by 50 basis points to 3.75%. Inflation in the country fell to 1.6% in September from 2% in August, the lowest since February of 2021.

Related Content