Tradeweb Exchange-Traded Funds Update – October 2024

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 58.4 billion in October, the best monthly performance so far this year. The proportion of transactions and notional volume executed via Tradeweb’s Automated Intelligent Execution (AiEX) was a record 90.0% and 27.7%, respectively.

Adam Gould, Global Head of Equities at Tradeweb, said: “This year has been consistently strong for our European ETF marketplace and October was no exception. Clients continued to embrace our request-for-quote (RFQ) protocol and automated execution tool, with the percentage of AiEX transactions breaking through the 90% barrier for the first time ever.”

Volume breakdown

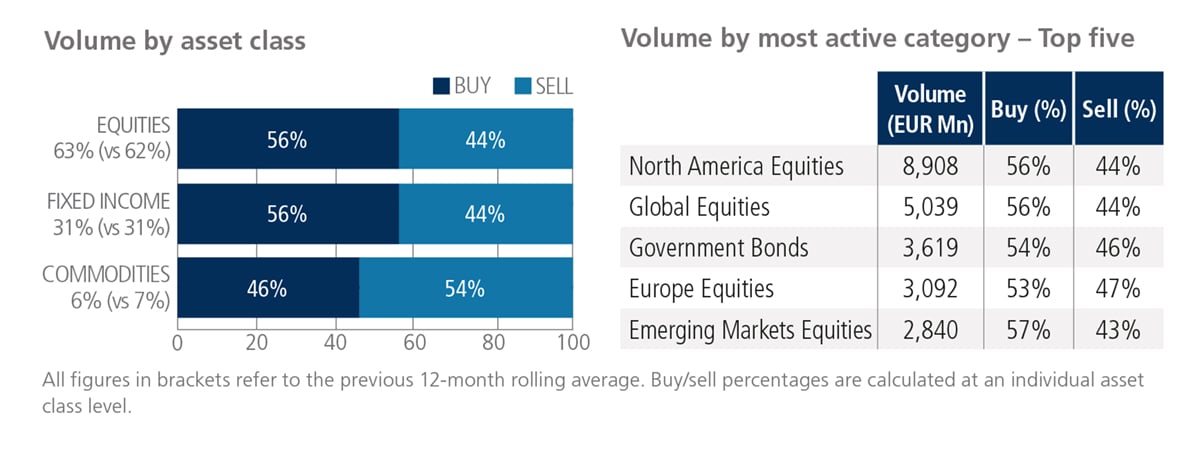

Fixed income and equity ETFs saw net buying in October, while ‘sells’ exceeded ‘buys’ by eight percentage points in commodity-based products. Trading activity in equity ETFs decreased to 63% from 65% in the previous month, while commodity-based ETFs rose to 6% from 4%. Fixed income ETFs remained unchanged at 31% of the overall platform flow. North America Equities was once again the most heavily-traded ETF category, with nearly EUR 9 billion traded over the month.

Top ten by traded notional volume

Equity products accounted for six of October’s ten most actively-traded ETFs, with the iShares MSCI USA ESG Enhanced UCITS ETF ranking first. The iShares $ Corporate Bond UCITS ETF held the second spot from September, while the iShares Core S&P 500 UCITS ETF moved up from fourth to place third at month end.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in October reached USD 57.2 billion.

Adam Gould, Global Head of Equities at Tradeweb, said: “In October, U.S. secondary market volumes were muted as a result of investor sentiment leading up to the U.S. election. However, trading activity in U.S.-listed ETFs in the final quarter of this year is still off to a strong start, as market participants prepare to position into year end.”

Volume breakdown

As a percentage of total notional value, fixed income accounted for 50% and equities for 44%, with the remainder comprising commodity and specialty ETFs.

Top ten by traded notional volume

Fixed income ETFs dominated October’s top ten list by traded notional volume. The iShares Short Treasury Bond ETF, which last ranked first in May last year, occupied the month’s top spot, while the iShares Broad USD High Yield Corporate Bond ETF dropped down one place to be ranked second.

Related Content

Tradeweb Exchange-Traded Funds Update – September 2024