Tradeweb Exchange-Traded Funds Update – May 2024

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 47.4 billion in May. The percentage of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool reached a platform record of 88.6%, while the proportion of volume was 24.5%, the second highest figure ever.

Adam Gould, head of equities at Tradeweb, said: “Total traded volume on our European platform was up 5.8% year-over-year in May. We had another record-breaking month for automation adoption, with AiEX making it possible to move large volumes with no manual intervention, providing major strategic gains for our clients.”

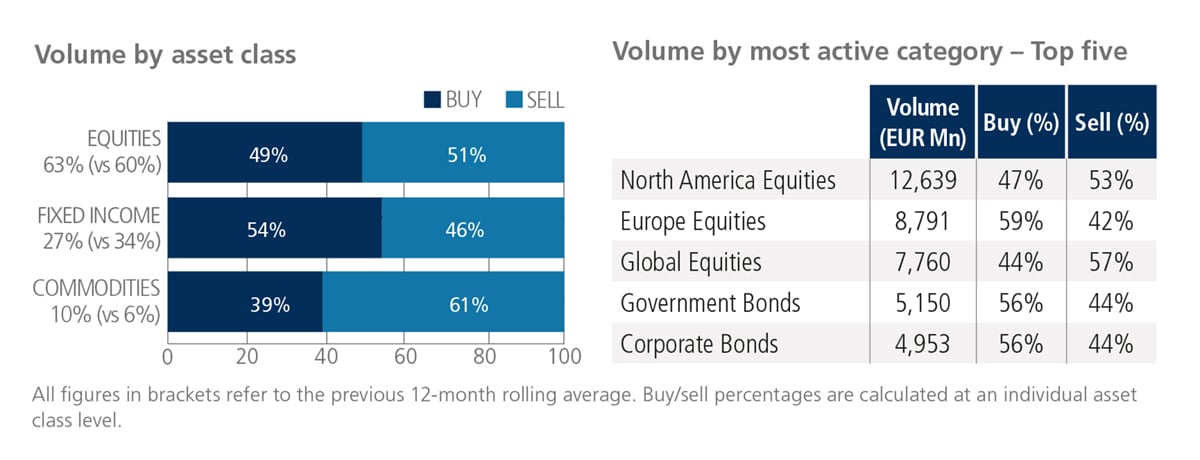

Volume breakdown

In May, trading activity in equity-based ETFs registered at 65% of the overall platform flow, while fixed income and commodities were at 27% and 8%, respectively. ‘Buys’ exceeded ‘sells’ for all ETF asset classes, particularly in equities and commodities. North American Equities was the most heavily-traded ETF category, with EUR 10.2 billion in total notional volume.

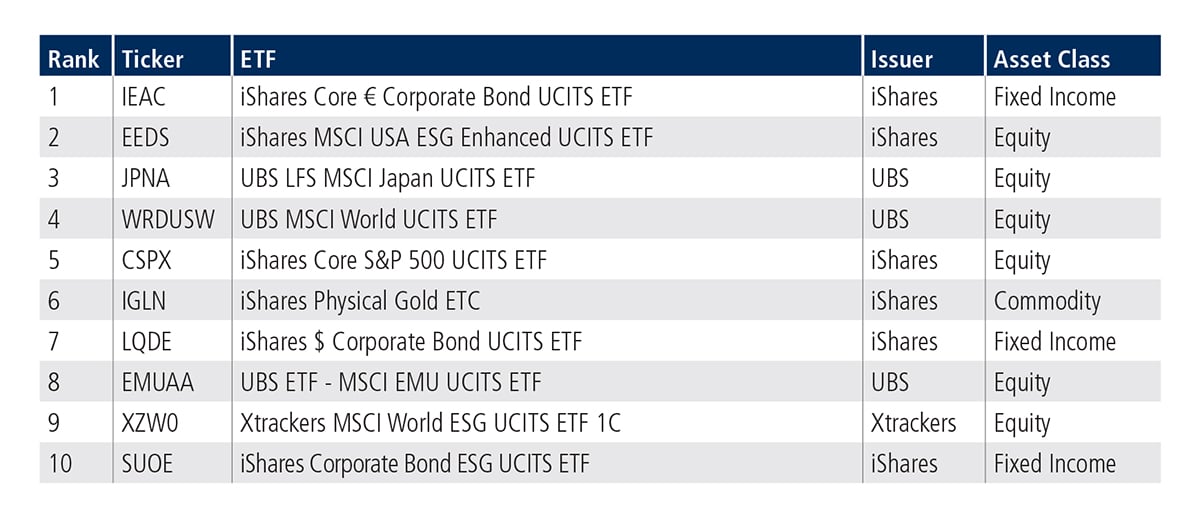

Top ten by traded notional volume

Six of the top ten ETFs by traded notional volume were equity-based products in May. The iShares Core € Corporate Bond UCITS ETF once again featured in first place, while the third spot was occupied by the UBS LFS MSCI Japan UCITS ETF; the last time the product appeared in the top five ranks was four years ago in May 2021.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in May reached USD 46.8 billion.

Adam Gould, head of equities at Tradeweb, said: “In the U.S., institutional ETF RFQ adoption remained strong this past month. Clients have continued to recognise the benefits, including better pricing, increased efficiency and immediate execution for traders and allowing things like straight-through processing, automated execution, and list and portfolio trading capabilities.”

Volume breakdown

As a percentage of total notional value, equities accounted for 56% and fixed income for 38%, with the remainder comprising commodity and specialty ETFs.

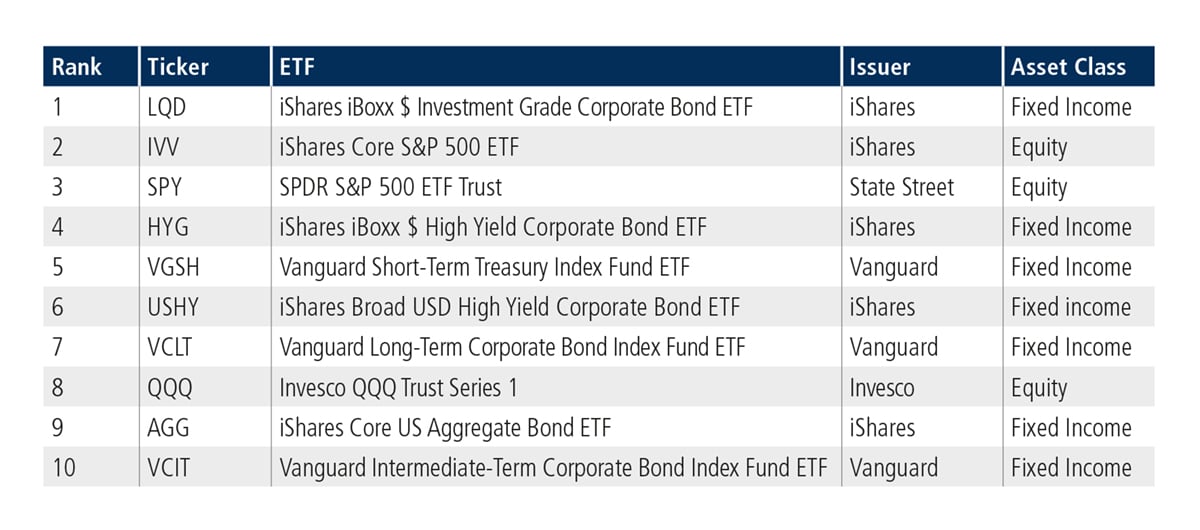

Top ten by traded notional volume

Fixed income products dominated May's top ten ETF list, with the Vanguard Intermediate-Term Corporate Bond Index Fund ETF ranking first. April's top product, the iShares iBoxx $ Investment Grade Corporate Bond ETF, moved down to fourth place in May.

Related Content