Tradeweb Exchange-Traded Funds Update – April 2024

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 54.7 billion in April. There was a record-breaking proportion of volume traded via Tradeweb’s Automated Intelligent Execution (AiEX) tool at 24.8%, while the percentage of transactions processed this way reached 87.3%, the second highest figure ever.

Adam Gould, head of equities at Tradeweb, said: “The second quarter of 2024 is off to a strong start, with total traded volume in Europe up 37.9% year-over-year in April. We are seeing clients becoming increasingly comfortable trading larger ticket sizes through AiEX, as they continue to reap the benefits of parameters-based execution.”

Volume breakdown

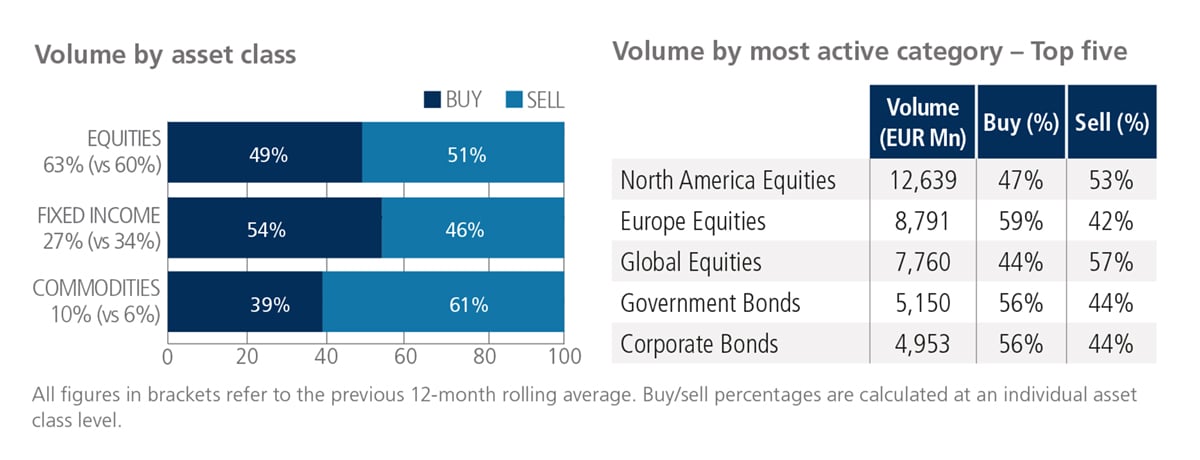

In April, trading activity in equity-based ETFs registered at 63% of the overall platform flow, while fixed income and commodities were at 27% and 10%, respectively. Fixed income was the only ETF asset class where ‘buys’ exceeded ‘sells’. In contrast, equity and commodity products saw net selling during the month. North American Equities was the most heavily-traded ETF category, with EUR 12.6 billion in total notional volume.

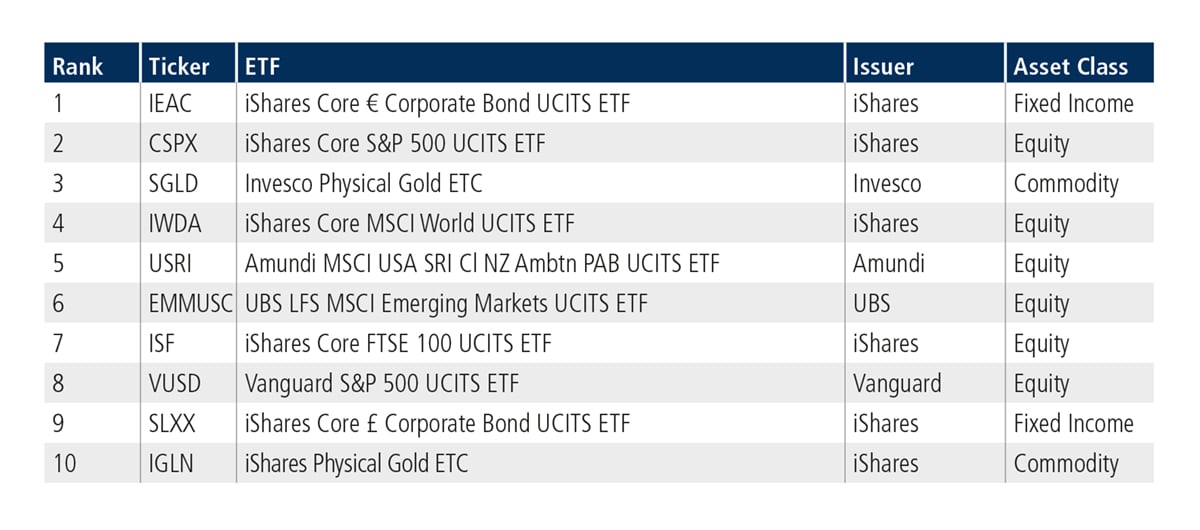

Top ten by traded notional volume

Six of the top ten spots were occupied by equity-based products in April, and three of these offer investor exposure to U.S. stocks. The iShares Core € Corporate Bond UCITS ETF featured in first place; the last time the product appeared among the top three ranks was July 2023.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in April reached USD 57.4 billion.

Adam Gould, head of equities at Tradeweb, said: “In the U.S., Tradeweb institutional ETF volumes were up 34.5% year-over-year, reflecting strong growth once again on our platform.”

Volume breakdown

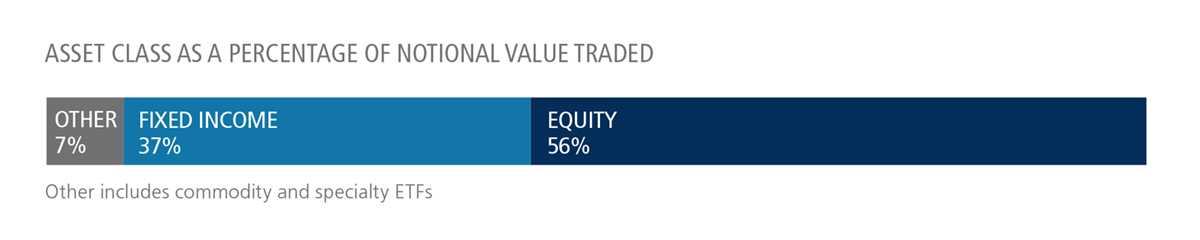

As a percentage of total notional value, equities accounted for 56% and fixed income for 37%, with the remainder comprising commodity and specialty ETFs.

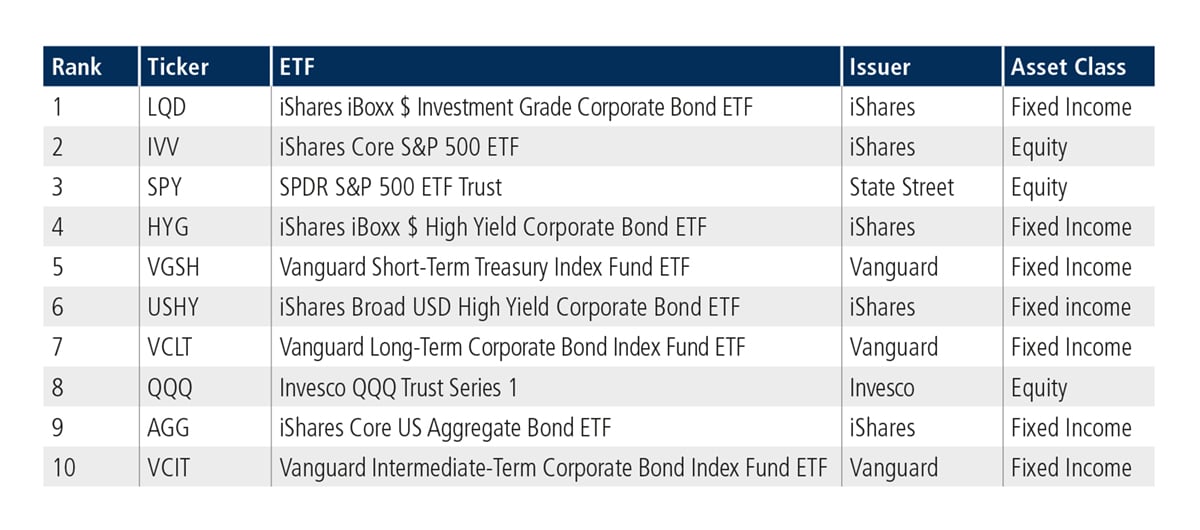

Top ten by traded notional volume

Seven of the top ten ETFs by traded notional volume were fixed income-based, with the iShares iBoxx $ Investment Grade Corporate Bond ETF ranked first. Last month’s top product, iShares Core S&P 500 ETF, moved down to second place in April.

Related Content

Tradeweb Exchange-Traded Funds Update – March 2024