From Model-to-Execution: How Asia-Based Hedge Funds Leverage Python and AiEX to Drive Execution Efficiency

Laurent Ischi

Head of APAC Automation, Tradeweb

Automated trading has been steadily rising since Tradeweb launched Automated Intelligent Execution (AiEX) in 2012. Initially, asset managers and private banks were the primary adopters. However, in the past two years, we’ve seen a significant shift as hedge funds have increasingly embraced AiEX. One major challenge for hedge funds was the need to send orders via FIX to Tradeweb when using an automated workflow – namely AiEX. Traditionally the portfolio manager or execution desk relied solely on the Tradeweb user interface (UI) to execute trades with no pre-trade FIX as this would require either an OMS or the Tradeweb Integrator Excel Plugin. The former is a technically demanding setup, while the latter only allows for partial workflow automation, limiting broader market adoption.

To address this hurdle, Tradeweb collaborated with clients to develop a Python API, thereby lowering the barrier to entry. Many clients already use Python for analysis and modeling, so this integration has been a game changer. It not only enables them to connect to Tradeweb in a familiar language, but also gives them full control over their orders.

Streamlining Workflows to Drive Competitive Advantage

In addition to the obvious efficiency gains from reducing latency between order generation and execution, the new approach has unlocked significant strategic value. For instance, by combining AiEX with Tradeweb’s Request-for-Market (RFM) trading protocol, clients can execute trades more discreetly, avoiding the directional exposure that would occur with the Request-for-Quote (RFQ) protocol. RFM also offers the advantage of dynamically determining the market conditions and economics at the precise moment of execution. The Python API enables hedge funds to tightly manage execution costs relative to the market midpoint while controlling for pricing anomalies.

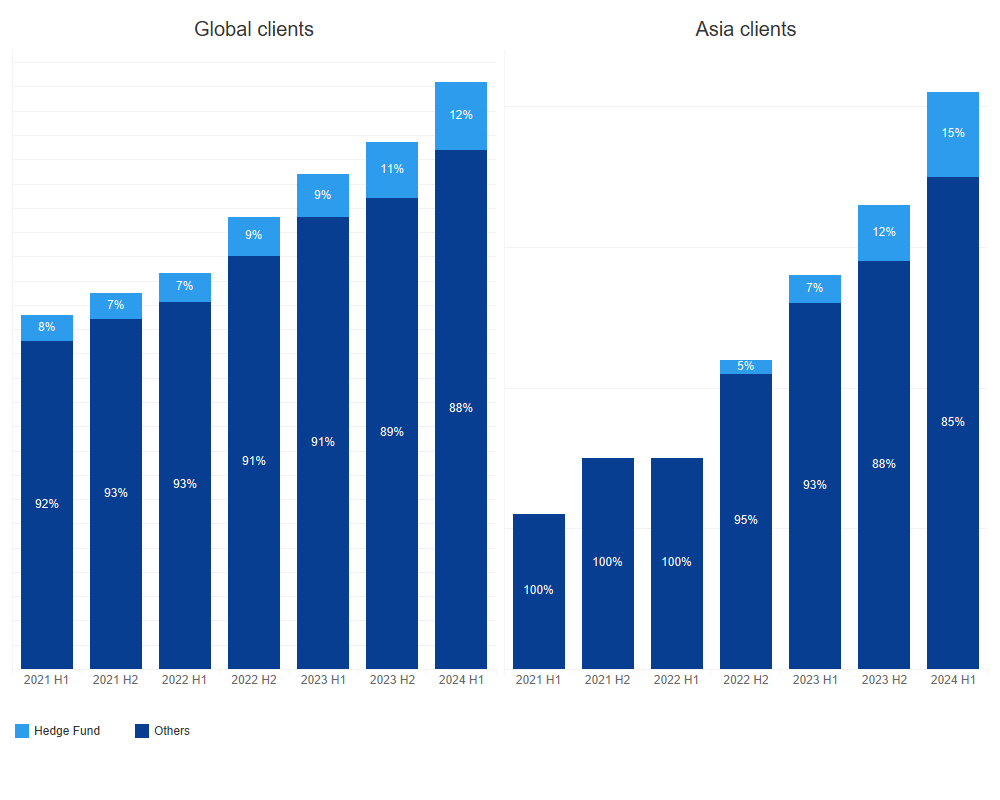

This direct model-to-execution approach has been steadily gaining traction among buyside clients globally, with APAC-based hedge funds leading the charge. As the charts below indicate, hedge funds accounted for 12% of AiEX users in the first half of this year, while firms in APAC made up 15% of total clients in the region – up from none just two years ago.

Direct Model-to-Execution Volumes by Client Type and Location

Charting the Path of Innovation

While the Python API was developed by a global Tradeweb team in close collaboration with clients, the first end-to-end automated trade using this capability was executed in Hong Kong, highlighting the region's strong interest in cutting-edge technology and shaping the future of over-the-counter (OTC) automation. Adoption has grown organically across all APAC regions since the launch, with ongoing significant demand. Although the majority of trading volumes currently focus on interest rate swaps, the capability is also expanding into the cash bonds market, and we expect continued growth.

Much like other Tradeweb innovations, which have refined and enhanced legacy workflows through subtle yet impactful improvements, the direct model-to-execution approach is proving its value with each new trade. We’re excited to see the further integration of the Python model more broadly across the APAC region.

Related Content