Five Years On, Portfolio Trading of European Credit Extending Reach, Growing in Sophistication

James Dale

Co-Head of International Developed Markets, Tradeweb

At times constrained by investors’ ability to value bonds and undercut by periodic macro events affecting markets generally, portfolio trading has evolved into a reliable mode of execution, and an efficient way to rapidly change the make-up of investors’ holdings. At the five-year anniversary of the launch of Tradeweb’s Portfolio Trading solution for European credit, we reflect on a protocol that has changed how our markets move big batches of bonds.

When portfolio trading for European corporates first launched, the idea of selling a mix of bonds on an all-or-nothing basis was novel. For as long as there were markets for European corporate debt, bonds had traded discretely, either alone or as non-contingent entries within an offer list. Through portfolio trading, trading desks could now bundle multiple names on a contingent basis, enabling them to negotiate the sale of all items in the basket on a net-proceeds basis, with no cherry picking from the list.

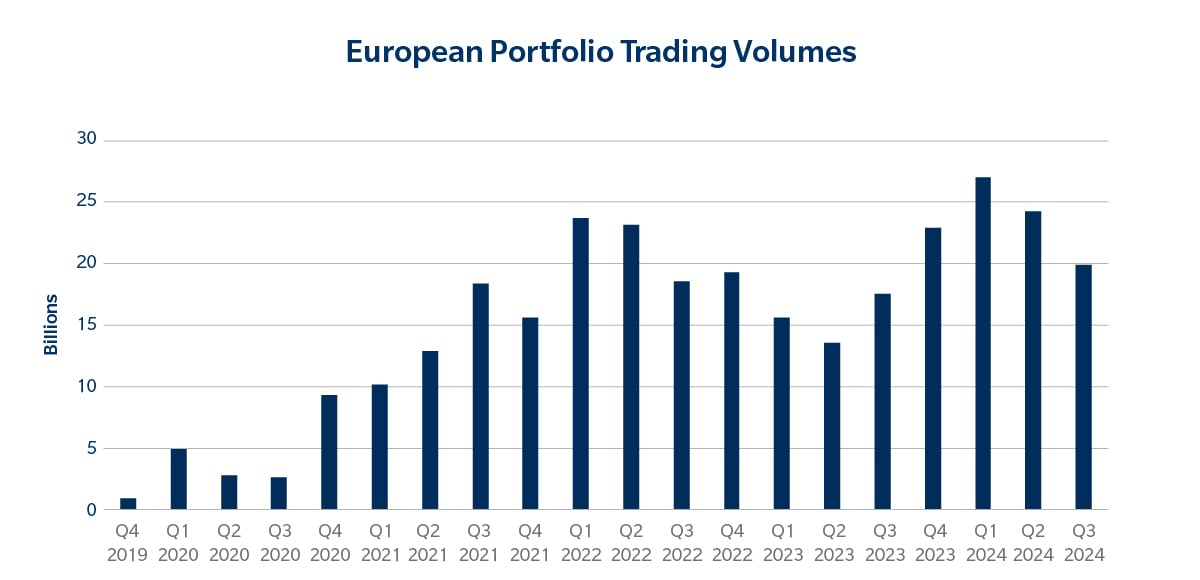

The protocol has grown in popularity as both the buy-side and sell-side have jumped in. In the past year, and for the first time, the total value of bonds traded in portfolio trades on the Tradeweb platform has exceeded $10 billion in three separate months. For the January to September period this year, portfolio trading volume on our platform is up 56% from the same period in 2023.

Like most new protocols, markets tend to test-drive their application first in asset classes with more volume, liquidity, and transparency. It’s no surprise, then, that portfolio trading in European credit built a foothold in high-grade bonds, before catching on in high yield.

Now, those trading credit have grown increasingly comfortable blending batches of both. The volume of mixed portfolios changing hands on the Tradeweb platform grew 280% between January and September this year, compared to the same period a year earlier. High yield volume, too, grew by 123% over the same period, while the volume of trades in investment-grade portfolios increased by 47%.

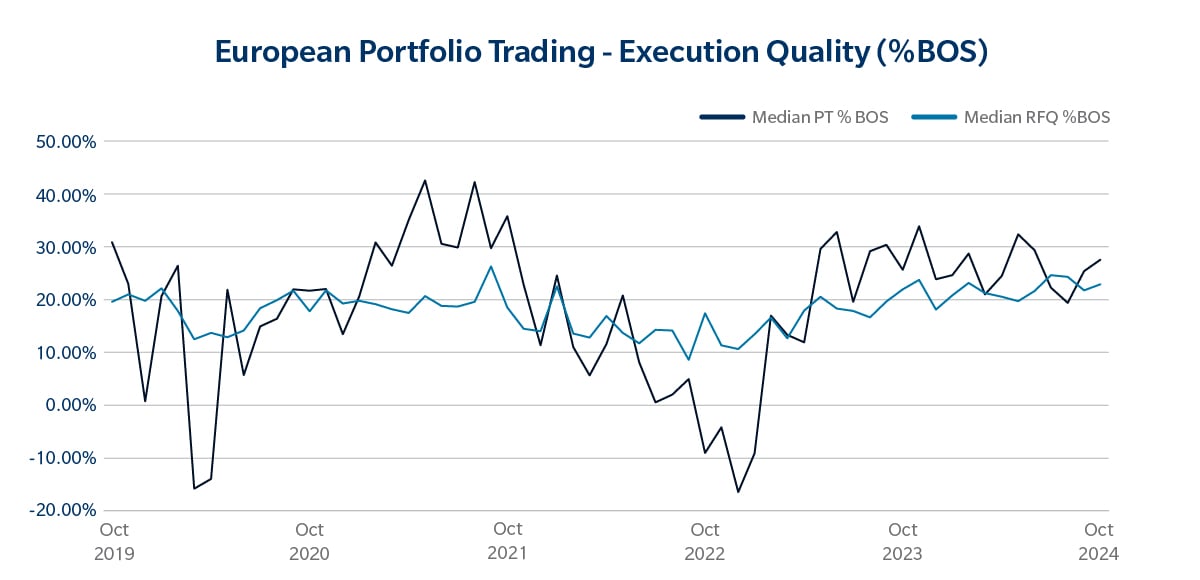

For their part, portfolio managers and trading desks are making wider use of newly available analytical tools, allowing them to better evaluate the risk-reward profiles when trading these large, diverse baskets of corporate bonds. The improved quality of execution, sometimes better than on individual Request-for-Quotes (RFQ), has come from dealers’ adjustments to operations to better support the protocol. More have aligned their algo, ETF market making, and line trading functions to expand their full-service offerings, broadening the universe of dealers able to conduct, and offer value in, portfolio trades.

Inconsistency, But Certainty

The development of portfolio trading for European corporates has not always been smooth going. In the early days, execution quality swung wildly, buffeted by macro events that drained liquidity from the overall markets. In early 2020, as Covid lockdowns started, portfolio trades and the influence of ETFs created large dislocations between the price of underlying bonds and ETFs and unique portfolio baskets. Again, in February 2022, when Russia invaded Ukraine, we saw a similar divergence. Then from September to December 2022, at the height of the Liability-Driven Investment (LDI) crisis in the UK Gilt market, we saw clients using the protocol to move large blocks of risk, which whilst execution costs were higher, allowed them to quickly trade and exit large positions.

Early critics of portfolio trading cited sellers’ habit of tucking unattractive bonds into the portfolio’s mix of credits, which would then impact the execution quality on the full list of bonds within the portfolio. That was, after all, one of the benefits portfolio trades touted – the ability to dispose of illiquid maturities or unfamiliar bonds alongside more valued issues. But for bidders, valuing the basket with those names was challenging without broad data and analytics to round out a comprehensive assessment of the portfolio.

A lot has changed. There is an increased familiarity with the protocol and a greater understanding of the impact on execution quality around how a portfolio trade is constructed. Also, more support from the sell-side and the dealers that offer the service, with the community of dealers in European credit growing from 15 in 2021 to 20 today, coupled with greater investment from platforms like Tradeweb, is contributing to the increased scale and analytics available around the protocol. The explosion in bond ETF issuance has helped dealers in building out their infrastructure to support this, and analytics for clients in how they think about optimizing their execution. All of this has fostered deeper conversations between the buy-side and sell-side; potential buyers now have more information pre-trade with which to compare portfolios among dealers. More data, better tools, and sharper analytics have turned what used to be a black box of risks into a more transparent book for optimizing pricing on these portfolios. This year, we have seen a vast range of use cases, from multiple portfolios of more than 1000 items with balanced risk profiles to portfolios with individual names amongst a list of more than 50 million in size. The appeal of doing such trades with certainty of execution and reduced market footprint resonates with an ever expanding client group.

Looking forward

As European credit markets continue to grow and electronify further, portfolio trading – and the tools and analytics available to evaluate and execute it – will evolve in lock-step with the needs of the markets. More clients, from real money managers and hedge funds to pension and sovereign wealth funds, are exploring the protocol as part of their execution strategies, introducing new use cases and new ways to refine our platform and offer even more sophisticated ways to engage in portfolio trades.

One of the next waves of innovation in portfolio trading we anticipate is helping clients to optimize their portfolios to achieve execution aims, but we won’t stop there. With five years of learning under our belts, and our clients’ growing confidence in portfolio trading, we will continue to expand the protocol’s application, including into new asset classes, as well as the potential for multi-asset portfolio trades in the near future. Our ethos has always been to collaborate with our clients to create more transparent, intelligent and efficient ways to trade, and as the use cases for portfolio trading continue to evolve, we will make sure the technology does too.

Related Content

What the Last Decade of Electronification Tells Us About the Future of U.S. Credit Markets