2024 Annual Client Letter

How 2024 Set the Stage for Next Gen Financial Markets

To our clients,

History tends to view broad-based transformation through the lens of a single seismic event. Consider what the first moon landing did for television in 1969, or how, nearly 40 years later, the collapse of Lehman Brothers became synonymous with the global financial crisis. While our brains crave simple explanations, the truth is often more complicated, more nuanced and sometimes even more serendipitous. Such was the case in 2024, as a number of disparate themes coalesced to accelerate the march towards more electronic markets.

We all predicted this year was going to be a wild ride and it has been. Amid rising geopolitical tensions, evolving regulations and shifts in monetary policy, markets adapted and even thrived. While this resiliency does not surprise me, it is rather incredible to consider how 2024 went from “let’s just get through this” to setting the stage for transformative innovation.

We’re seeing debt markets continue to grow and central banks are less often acting as buyers, which has been a big opportunity for the private sector in 2024. Asset managers and hedge funds are leaning into algorithmic trading and automation. Electronic market makers and banks are expanding into new asset classes, reshaping the trading landscape. From AI and digital assets to evolving market structure and liquidity providers, these changes are building a foundation for a future where technology will continue to fundamentally reshape financial markets.

Tradeweb occupies a unique vantagepoint situated between banks, asset managers, hedge funds, trading firms, retail client-facing firms and corporate treasurers, among others. Here are some of the themes that we believe defined 2024, and that will influence the year ahead for our markets.

Markets Adapt to Uncertainty

Global markets encountered volatility throughout the entire year. However, against a backdrop of several highly-consequential elections in the U.S. and Europe, steadily rising geopolitical tensions and a global economy that continued to reflect uncertainty, fixed income markets were able to digest and move past significant and powerful moves.

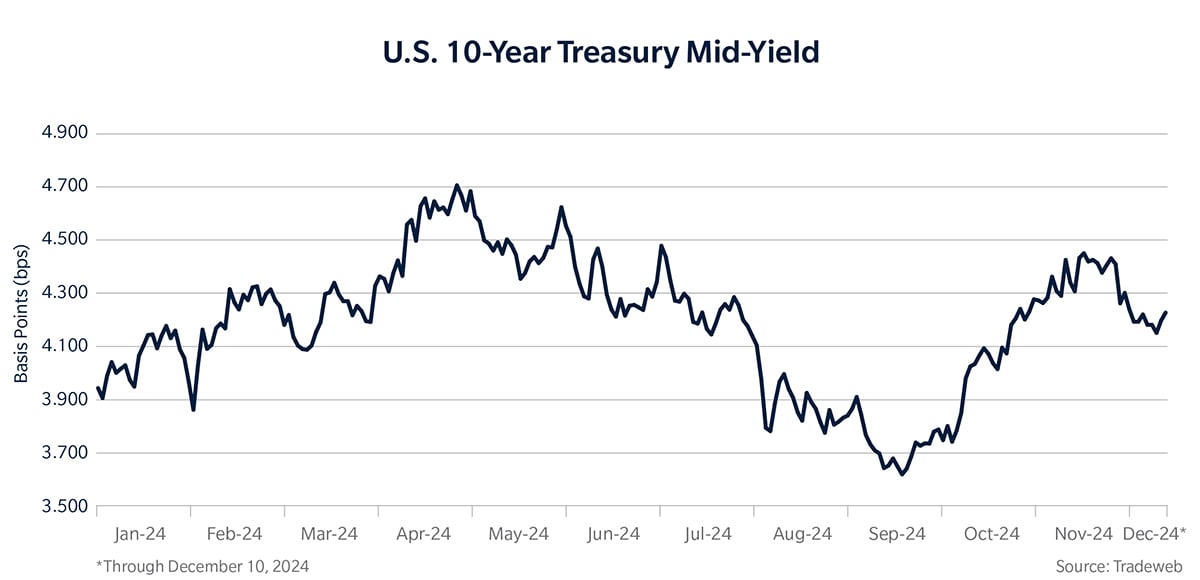

During the five months preceding the Fed’s first rate cut in September, U.S. 10-year Treasuries fell by 100+ basis points (bps), only to reverse course once recessionary fears began to subside after the Fed’s 50-bps cut. German Bunds and UK Gilts had similar trajectories, as the Bank of England and European Central Bank moved rates lower.

The Bank of Japan’s historic move to end eight years of negative rates brought 10-year JGB yields to a high of 1.1% in July. JGB yields are about to end the year at similarly elevated levels, as the market digests stronger data and prices in a potential rate hike, while the other major central banks have been cutting.

Ultimately, what we saw from our position at the center of institutional and wholesale rates trading was an environment of quiet confidence. No matter what the news cycle looked like on any given day, market participants had several ways to manage that risk. This agility was apparent in retail markets as well, where market participants adapted to shifting rates by embracing electronic muni bond trading and taking advantage of enhanced liquidity and improved efficiency. Markets were much more resilient than anyone expected in 2024, and players across markets came together to drive trading to record levels by taking advantage of technologies that enabled them to stay nimble.

Markets More Connected Than Ever

One shift that has demanded increased agility this year has been the breaking down of silos between asset classes and trading workflows. Driven in part by technology, which now makes it easier to perform price discovery and execute trades incorporating several different asset classes, and by the growth of ETFs, which make it possible to quickly and cost- effectively access liquidity, the trend has created a significant shift in the way institutional markets operate.

The big ETF story this year was of course the January launch of spot Bitcoin ETFs. While markets had eagerly awaited final regulatory approval, the ETF ecosystem was already primed and ready to go. For Tradeweb, that meant lining up a strong list of dealers ready to quote these ETFs from day one, contributing to what became a historic and orderly launch in the face of strong investor interest. Interest in Bitcoin ETFs continued throughout the year, culminating in a significant milestone in November when the U.S. Bitcoin ETFs topped $100 billion in combined total assets.

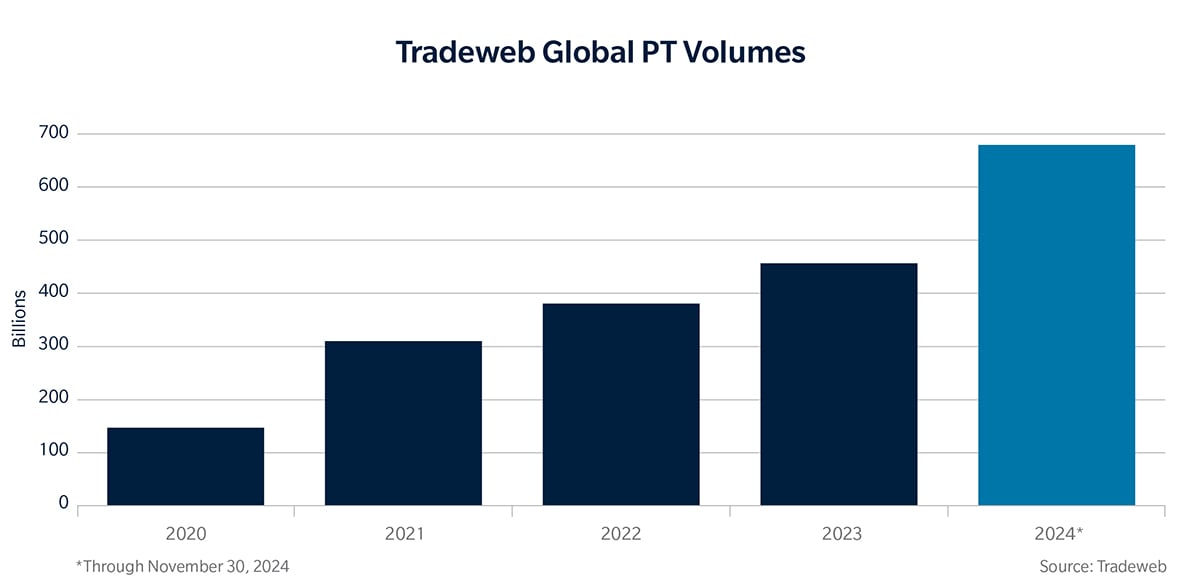

In credit, electronic portfolio trading played a key role in helping this ETF evolution increasingly take root. The technology, which allows investors to bundle hundreds of bonds in one basket, negotiate a price at a portfolio level with multiple dealers and execute the trade in a single transaction, has made it much easier to execute these blocks in an efficient manner. Through November of this year, $676.6 billion in portfolio trades –well over half a trillion– have been executed on Tradeweb’s global credit platform, a record high since we began offering the solution in U.S. Credit markets in early 2019.

More broadly, market participants are increasingly taking a whole market view of the trading landscape and they are finding ways to deploy cross-asset strategies more efficiently and frequently than ever. To keep nurturing that evolution, Tradeweb acquired r8fin in 2024, an algorithmic technology provider that, among other things, facilitates multi-legged trades between U.S. Treasury cash and futures markets.

Collectively, these types of workflow innovations are making it easier for market participants to seamlessly express a view across multiple markets, effectively closing the gaps between asset classes. Whether it’s corporate bonds, government debt, interest rate swaps, or emerging markets bonds – these innovations have created a one-stop shop approach toward trading across asset classes.

Digital Assets: Revolutionizing Global Markets

In 2024, the way we traded continued to transform, with the increased prominence of digital asset classes. The continued evolution of blockchain technology, combined with growing client demand, has made digital assets a focal point in the ongoing transformation of financial markets.

We view blockchain technology as a catalyst for further adoption of electronification across newer adjacent markets. Similar to the early days of electronic trading, various alliances are forming to identify new and interesting ways to advance the trading of digital assets. For Tradeweb, that has meant collaborating with a range of partners and initiatives including BlackRock, Securitize, Digital Asset, Goldman Sachs, Canton Network and Alphaledger, among others.

Integrating digital assets into this fixed income ecosystem is a natural next step in the evolution of electronic trading. Whether it’s tokenized bonds, digital currencies and funds linking issuance, or settlement and custody to trading protocols via blockchain, Tradeweb is actively preparing to support clients as they explore new asset types. Our goal is to make trading digital assets as seamless as any other asset class, ensuring clients can access liquidity, manage risk and capitalize on opportunities with confidence.

Moreover, digital assets align perfectly with Tradeweb’s multi-asset class approach. As markets become more interconnected, clients increasingly expect the ability to trade across asset types—bonds, equities, derivatives, and digital assets—with the same ease and efficiency as they’re used to today.

Evolving Market Structure and New Liquidity Sources

Of course, it isn’t just new asset classes that are introducing significant changes to the markets. We also saw some of the biggest changes ever introduced to the underlying market structure of the $26 trillion U.S. Treasuries market and the $4.5 trillion U.S. repurchase agreement (repo) market. New rules set to be phased-in beginning in March 2025 will require U.S. Treasury and repo trades to be processed through a central counterparty clearinghouse, with Treasury cash clearing beginning December 31, 2025, and repo clearing beginning June 30 of 2026. While questions remain— particularly in light of administrative changes in January 2025—we are committed to working with our clients to prepare for these new rules.

Broadly reminiscent of the central clearing requirements that were introduced in the derivatives markets under Dodd-Frank, the new mandate has started to raise important questions around clearing capacity and increased capital requirements. These concerns are slightly more pronounced in the repo market, where details around clearinghouse netting models and new complexities introduced into the trading workflow could have a big impact on trading costs. In both cases, however, lessons learned in the post Dodd-Frank swaps market about how technology can be used to streamline trading workflows have helped to ameliorate many of the marketplace’s biggest fears.

Similarly, lessons learned over the course of this year, as the settlement cycle for all U.S. securities transactions was transitioned to T+1, are now being considered for the UK and EU to help streamline that process.

Throughout, the growth of electronic trading and continued advances in its execution on the part of market participants have helped the markets digest sweeping changes like this with relative calm. Because more volume is trading electronically, the operational adjustments needed to support these kinds of major structural changes are less complex than they used to be in the analog trading world, and market participants are adjusting quickly.

Leading banks have met this moment with innovations of their own, and could face relief from capital constraints under a Republican-majority U.S. Congress beginning in 2025. And hedge funds are increasingly focused on the ability to trade multiple asset classes efficiently, making greater use of algorithmic trading and automation. Taken together, these shifts have broader market implications, and fuel the one-way movement we’ve seen towards more electronic markets.

Disruptive Technology at the Forefront

Of course, no look back at the key trends that shaped financial markets – and the world – in 2024 would be complete without acknowledging the massive impact AI has had on everything from financial analytics to global elections. For our part at Tradeweb, we see some of the most exciting applications of AI playing out in the pre-trade analytics space, where we’ve introduced technology that can optimize the dealer selection process, as well as price bonds where no recent trade data is available.

While it’s still early days for this capability, its central function – breaking each transaction down into its core building blocks, aggregating all available information on each of those variables and assimilating that data into a recommendation – represents an enormously exciting prospect for future technology development using AI.

In many ways, the story of 2024 in fixed income, derivatives and equity markets is the story of several years of technological innovation colliding with practical, real-world problem solving to address new challenges and unlock opportunities throughout the trading workflow. Now, with the introduction of newer technologies, such as multi-asset class trading capabilities, blockchain and digital assets and, of course, AI-driven tools, we’re seeing the pieces come together to propel significant advancements in global marketplaces, fostering and expediting key developments across our markets.

Empowering Next-Gen Markets

As a whole, the key milestones that made this year noteworthy were really the ones that kept markets from experiencing considerable headwinds. Against a backdrop of major regulatory reforms, a shaky macroeconomic situation and a technological revolution, markets adapted and continued to progress forward in 2024.

From where I sit, the glue holding things together was constant innovation and close collaboration between market participants, trading platforms, clearinghouses, regulators and monetary authorities to keep adapting to changing dynamics and new challenges with creative solutions. While technology has been a big enabler, allowing the kinds of real-time strategy shifts necessary to manage periods of uncertainty, collaboration has actually been the wild card. Whether it’s breaking down silos between trading desks to execute a multi-asset class strategy or working together to find the right tech tweaks needed to navigate new central clearing requirements, stakeholders across financial markets have been working together to find the most practical paths to the future.

This renewed spirit of collaboration supercharged by technology sets the stage for an exciting new chapter. Tradeweb is proud to stand with you as a partner, helping to navigate change and create new opportunities. Together, we are shaping the next era of financial markets.

Thank you for your trust and partnership.

Billy Hult

CEO, Tradeweb

Click here to download the pdf version of the letter.

Click here to view our 2023 annual client letter.

Click here to view Tradeweb disclosures.