Tradeweb Government Bond Update – September 2024

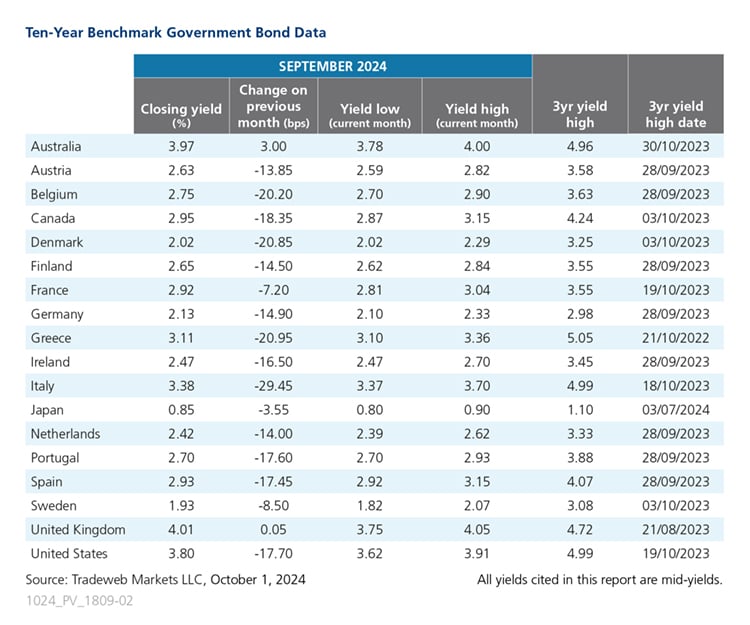

September saw 10-year global government bond yields decrease, with only those for the United Kingdom and Australia bucking the trend. The UK 10-year Gilt yield finished at 4.01%, only a fraction higher than August month end. The GfK Consumer Confidence indicator fell to -15 in September, while the S&P Global UK Manufacturing PMI also dropped to 51.5, down from a 26-month high of 52.5 in August. On September 18, the Bank of England voted to maintain interest rates at 5%, after deciding to reduce rates by 25 basis points at its prior meeting.

Over in Australia, the 10-year benchmark note mid-yield rose by three basis points to close September at 3.97%. The Westpac Melbourne Institute Consumer Sentiment Index dipped 0.5% from 85 to 84.6 during the month. Staying in Asia Pacific, the Bank of Japan unanimously decided to hold interest rates at 0.25% on September 20. The country’s 10-year government bond yield declined by almost four basis points to 0.85%. The annual inflation rate increased slightly to 3% in August from 2.8% the month before.

Continuing the busy month for central bank meetings, the Federal Reserve announced on September 18 that it would cut interest rates for the first time in four years by 50 basis points to a range of 4.75%-5%. The mid-yield on the U.S. 10-year Treasury fell by 18 basis points to end the month at 3.8%. Inflation in the U.S. slowed for the fifth consecutive month to 2.5%, the lowest level since February 2021.

In neighbouring Canada, the 10-year government bond yield decreased by 20 basis points to 2.95% at month-end. The country’s central bank also announced at its September meeting that it would reduce interest rates to 4.25%. However, it opted for a more modest 25 basis point cut compared to its U.S. counterpart.

Continuing the trend seen in the U.S. and Canada, the European Central Bank announced on September 12 that it would lower interest rates to 3.5%. Preliminary figures revealed inflation in the Eurozone had dipped below the central bank’s 2% target to 1.8% in September. The continent’s largest mover was once again the Italian 10-year government bond, whose yield registered at 3.38%, almost 30 basis points lower than August’s figure of 3.67%. The country’s inflation rate also fell considerably to 0.7% in September from 1.1% the month prior.

September’s second largest mover was the yield on Greece’s 10-year benchmark note, which came in at 3.11%, down by 21 basis points compared to the previous month. The annual inflation rate in the country rose slightly from 2.7% in July to 3% in August. The S&P Global Greece Manufacturing PMI posted 50.3 in September, down from 52.9 the month prior, remaining in expansion territory, but revealing the slowest pace of growth for the manufacturing sector in a year.

Meanwhile, Germany’s 10-year Bund mid-yield dropped 15 basis points in September to 2.13%. According to preliminary estimates, the country’s annual inflation rate fell to 1.6% from 1.9% in August, and at the same time, the HCOB Germany Manufacturing PMI plunged to a 12-month low of 40.6 from 42.4 in the previous month.

Related Content