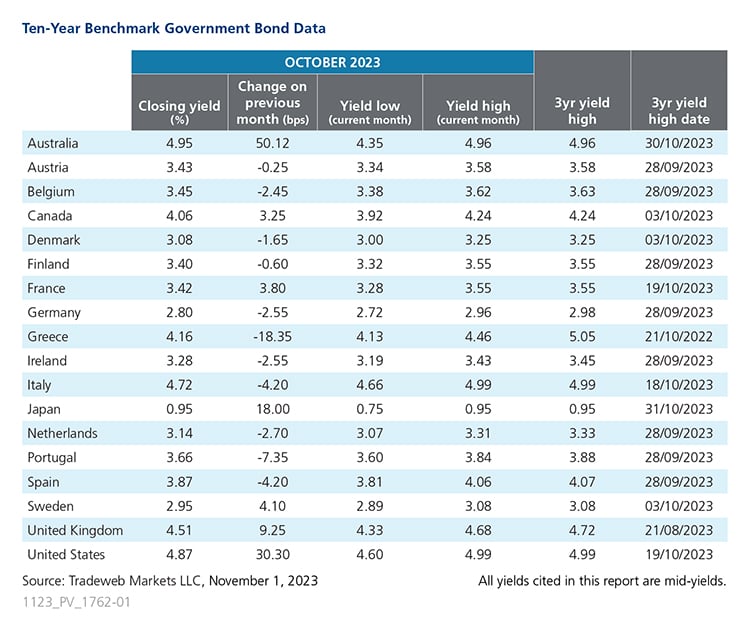

Tradeweb Government Bond Update – October 2023

October was a mixed month for government debt markets. Ten-year benchmark bond yields for Australia, Japan and the U.S. experienced double-digit increases, while those for Europe’s peripheral countries fell across the board. The month’s biggest mover Australia saw the mid-yield on its 10-year benchmark note climb 50 basis points to finish at 4.95%. The Westpac-Melbourne Institute Index of Consumer Sentiment rose 2.9% to 82 in October, up from 79.7 in September, with the country’s inflation rate at 5.4% year-on-year in the third quarter of 2023.

At the latest Bank of Japan meeting on October 31, a majority 8-1 voted to modify the bond yield control by re-defining 1% as an “upper bound” with room for allowance, rather than a rigid cap, while maintaining interest rates at -0.1%. The Japanese 10-year government bond yield closed at 0.95%, 18 basis points higher than September’s month end.

Europe’s biggest mover Greece saw 10-year government bond yields fall by 18 basis points to 4.16%. The country’s credit rating was raised to investment grade by Standard & Poor’s, the third such upgrade this year. This new status means Greek bonds can now be included in global market indices, and are no longer subject to the ECB’s exemption provisions. Annual inflation rate eased to 1.6% in September 2023, the lowest since July 2021, from 2.7% in the previous month.

Meanwhile, Italy’s 10-year benchmark bond yield finished at 4.72%, a drop of four basis points over the month. On October 16, Prime Minister Giorgia Meloni announced a budget increase to 4.3% of GDP from 3.6% under current trends, as well as measures worth approximately EUR 24 billion in tax cuts and higher spending.

In Germany, the 10-year Bund yield closed the month at 2.80%, down from 2.83% on September 29. The country’s inflation rate fell to 3.8%, marking a sharp decline from September’s 4.5%. The HCOB German Manufacturing PMI registered at 40.8, up slightly from the previous month’s 39.6, but still within sub-50 contraction territory.

Elsewhere in Europe, the UK’s 10-year Gilt yield ended October at 4.51%, rising nine basis points from September 29. The inflation rate remained stable at 6.7% in September, holding at August’s 18-month low. The GfK Consumer Confidence Index fell nine points to a three-month low of -30 in October, and the S&P Global/CIPS UK Manufacturing PMI came in at 44.8, up from 44.3 in the month prior.

Across the Atlantic, Mike Pence dropped out of the race for the 2024 presidential election in the U.S., where the inflation rate remained steady at 3.7% according to September numbers. The Treasury 10-year mid-yield dropped 30 basis points in October to 4.87%, while its Canadian equivalent closed at 4.06%, a slight increase of three basis points from the month prior. The annual inflation rate in Canada declined to 3.8% in September from 4% in August.

Related Content