Tradeweb Government Bond Update – November 2024

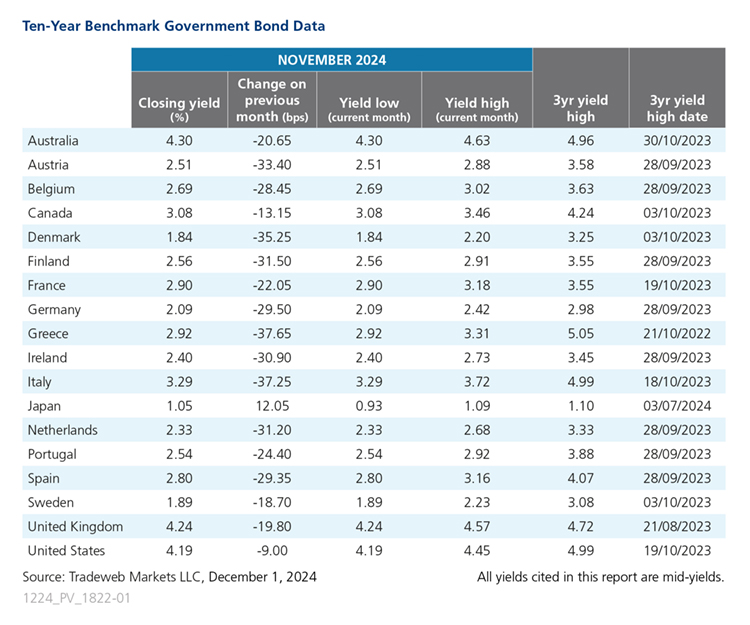

Apart from Japan, global government debt markets reversed October’s sell-off in November, with the five biggest movers all in Europe. The month also saw weak economic data published in the Euro area, starting with the HCOB Flash Eurozone Manufacturing PMI, which dropped to 45.2 from 46 in October.

On November 28 and for the first time on record, France’s borrowing costs surpassed those of Greece amid mounting investor concerns over Prime Minister Michel Barnier’s planned budget. The country’s annual inflation rate rose to 1.3% in November from 1.2% in October, the highest level in three months, and its 10-year bond yield declined by 22 basis points to 2.9%.

November’s largest mover, the Greek 10-year government bond mid-yield, ended the month 38 basis points lower at 2.92%. The S&P Global Greece Manufacturing PMI fell to 50.9 in November from 51.2 in the previous month, marking the second-slowest growth rate in manufacturing activity this year.

Elsewhere in Europe, Italy’s GDP growth rate registered at 0% in the third quarter of 2024, down from the previous quarter’s figure of 0.2%. The Italian 10-year benchmark note yield closed the month 37 basis points lower at 3.29%. Meanwhile, the annual inflation rate rose to 1.4% in November from 0.9% in the previous month, the highest figure in a year.

The German 10-year Bund mid-yield ended the month 30 basis points lower at 2.09%. The HCOB Germany Manufacturing PMI increased slightly to 43 in November from 42.6 in October. The country’s inflation rate climbed to 2.2% from 2% in October, above the European Central Bank’s inflationary target of 2% and the highest level in four months.

In the UK, annual inflation rate also soared to a six-month high of 2.3% in October from 1.7% the month prior, and above market expectations of 2.2%. The UK 10-year Gilt mid-yield decreased by almost 20 basis points to 4.24% at month-end. The GfK Consumer Confidence indicator increased by three points to -18 in November from -21 the prior month, while the S&P Global UK Manufacturing PMI eased to 48, down from October’s 49.9.

Across the Atlantic, Republican Donald Trump beat Democratic candidate Kamala Harris to win the U.S. presidential election on November 6. The U.S. 10-year Treasury mid-yield dropped by 9 basis points to 4.19%, the smallest mover for the month. Quarterly GDP figures revealed the U.S. economy expanded 2.8% in Q3 this year, and the annual inflation rate accelerated to 2.6% in October, up from 2.4% in September, which was the lowest reading since February 2021.

In neighbouring Canada, the country’s GDP grew by 0.3% in the third quarter, down slightly from the previous two quarters’ figure of 0.5%. The Canadian 10-year government bond yield declined by 13 basis points to end November at 3.08%, while the annual inflation rate rose to 2% in October from an over three-year low of 1.6% in the prior month.

Moving to Asia Pacific, Japan’s 10-year benchmark bond mid-yield climbed 12 basis points to end November at 1.05%. The inflation rate in the country decreased slightly to 2.3% in October from 2.5% in September, marking the lowest reading since January this year. Over in Australia, the 10-year government bond mid-yield fell by 21 basis points to 4.3% at the end of the month. The Westpac Melbourne Institute Consumer Sentiment Index increased by 5.3% to 94.6 from 89.6 in October.

Related Content