Tradeweb Government Bond Update – May 2024

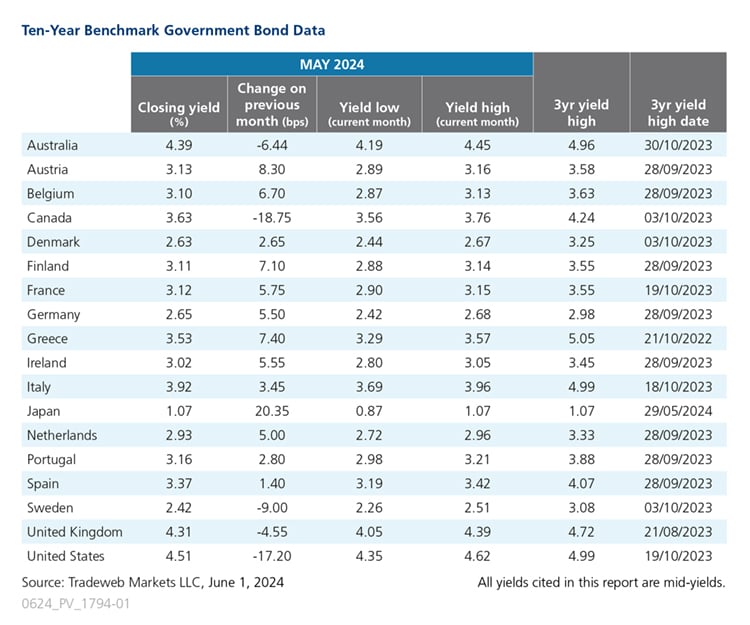

May was a mixed month for global government debt markets, with 10-year bond yields experiencing both increases and decreases across the board. The month’s biggest mover was the yield on Japan’s 10-year benchmark note, which climbed 20 basis points to 1.05%. The last time Japanese 10-year mid-yields reached above 1% was more than 12 years ago in early April 2012. Meanwhile, the country’s annual inflation rate fell for a second consecutive month to 2.5% in April from 2.7% in March.

In contrast, Australia’s 10-year government bond yield declined by 6 basis points to 4.39% over the course of the month. The Westpac Melbourne Institute Consumer Sentiment Index dipped 0.3% to 82.2 in May from 82.4 in April.

Across the Pacific, the yield on the U.S. 10-year Treasury dropped by 17 basis points to 4.51%. The inflation rate in the U.S. eased to 3.4% in April from 3.5% in March, which was the highest reading since September last year. Similarly, in neighbouring Canada, the inflation rate also slowed to 2.7% in April from 2.9% the previous month, while the country’s 10-year bond mid-yield fell 19 basis points to close the month at 3.63%.

In the UK, the 10-year Gilt yield ended the month at 4.31%, a decrease of 5 basis points from the month prior. On May 8, the Bank of England announced it would maintain interest rates at 5.25%, while the inflation rate in the UK lessened to 2.3% in April 2024, the lowest since July 2021. The GfK Consumer Confidence Index rose to -17 in May from -19 in April, posting the highest reading since December 2021. The S&P Global/CIPS UK Manufacturing PMI also climbed to 51.2 in May from 49.1 in April, marking its highest level since July 2022.

In the Euro area, the yield on Sweden’s 10-year benchmark note dropped 9 basis points to 2.42%. The nation’s inflation rate contracted slightly to 3.9% in April from 4.1% in the previous month, marking the lowest reading since January 2022. Over in Germany, the 10-year Bund mid-yield closed May 6 basis points higher at 2.65%, while the inflation rate edged up to 2.4%, compared to a three-year low of 2.2% in each of the previous two months. The HCOB Germany Manufacturing PMI was confirmed at 45.4 in May, the highest level in four months.

Moving to France, the inflation rate held steady at 2.2% in May, the same as in April, while the yield on its 10-year government bond rose by 6 basis points to 3.12%. Its Italian equivalent increased slightly to 3.92% from 3.89% the month prior, while the country’s inflation rate remained unchanged in May at 0.8%.

Related Content