Tradeweb Government Bond Update – June 2024

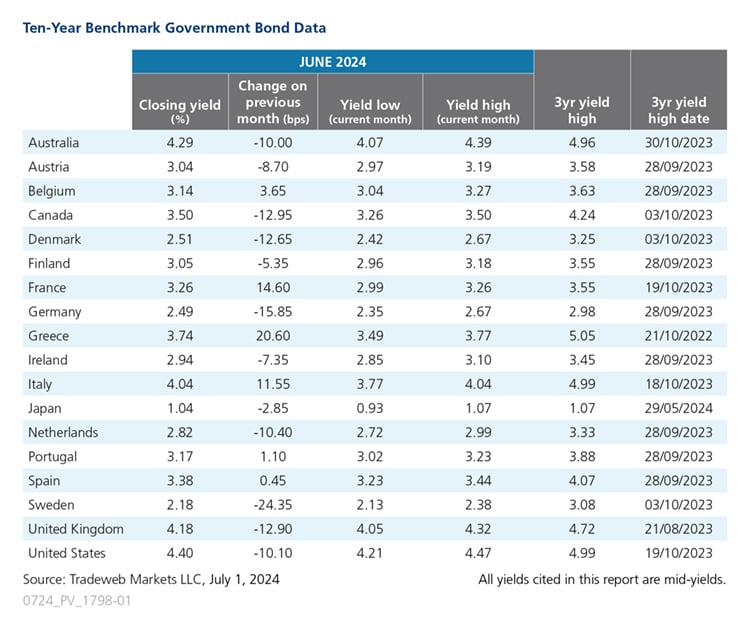

June was a mixed month for 10-year government bond yields, with those for Sweden registering the largest move, closing 24 basis points lower at 2.13%. On June 27, the country’s central bank, Riksbank, kept interest rates unchanged following its first cut in eight years at the previous meeting. Meanwhile, the Swedish consumer confidence indicator increased to 93.3 in June, up from 91.3 in May.

On June 9, the European Parliament election results produced another win for the European People’s Party (EPP) who secured the most parliamentary seats, while far-right parties won record support in this year’s vote. In France, President Emmanuel Macron called for a snap election earlier in June, with Marine Le Pen’s far-right National Rally (RN) winning the first round of voting on June 30. The country’s 10-year bond yield climbed 15 basis points over the month to 3.26%. At the same time, France’s consumer confidence indicator declined to 89.5 in June, edging down from 90.1 in May, while its business confidence indicator also decreased slightly to 98.6 from 99 during the same period.

Elsewhere in the Euro area, there was a sell-off in Greece’s government bond market, with the yield on its 10-year benchmark note rising by 21 basis points to 3.74%. The annual inflation rate in Greece eased to 2.4% in May, the lowest figure since September 2023. Over in Germany, the 10-year Bund mid-yield finished 16 basis points higher at 2.49%. The HCOB Germany Manufacturing PMI fell to 43.4 in June from 45.4 the month prior.

The yield on the Italian government bond rose by 12 basis points to 4.04%, while the annual inflation rate was 0.8% in June, remaining unchanged from the prior two months. Meanwhile in the UK, the 10-year Gilt yield ended the month 13 basis points lower at 4.18%. On June 19, the Bank of England announced it would maintain interest rates at 5.25%. The GfK Consumer Confidence Index rose to -14 in June from -17 in May, improving for the third consecutive month to the highest figure since November 2021. The S&P Global/CIPS UK Manufacturing PMI was revised lower to 50.9 in June compared to 51.2 the prior month.

Across the Atlantic, the yield on the U.S. 10-year Treasury decreased by 10 basis points to 4.40%. On June 12, the Federal Reserve left interest rates unchanged at between 5.25% to 5.5%. The annual inflation rate in the country slowed to 3.3% in May, the lowest in three months, and June’s University of Michigan consumer sentiment for the U.S. was revised higher to 68.2.

On June 5, the Bank of Canada cut its interest rate by 25 basis points to 4.75%, and the country’s 10-year bond yield dropped 13 basis points to end the month at 3.50%. Inflation rose to 2.9% in May from a three-year low of 2.7% in April.

In the Asia Pacific region, the yield on Japan’s 10-year benchmark note fell slightly by 3 basis points to 1.04%. At its June meeting, the Bank of Japan unanimously maintained interest rates between 0% to 0.1%, while the inflation rate accelerated to 2.8% in May from 2.5% in April.

Related Content