Tradeweb Government Bond Update – July 2024

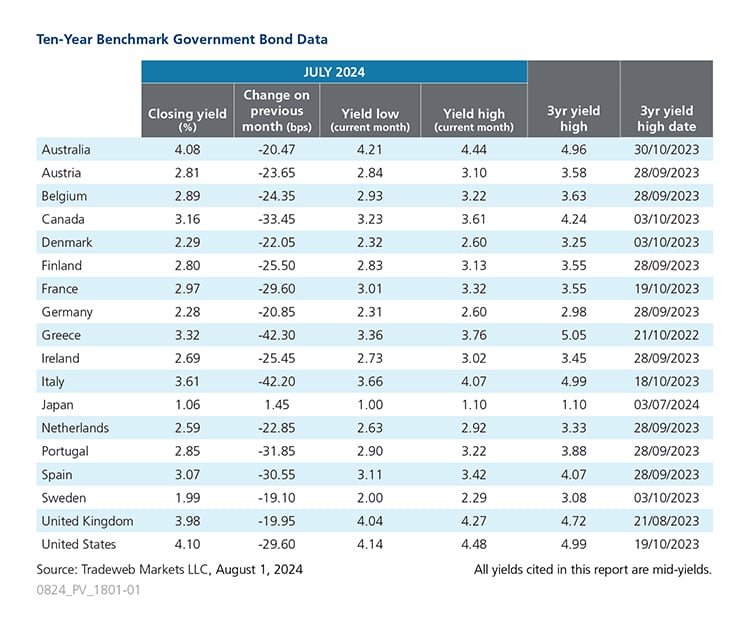

Ten-year government bond yields decreased in July, with only those for Japan bucking the trend, rising by over one basis point to end the month at 1.06%. On July 30, the Bank of Japan voted to raise interest rates to 0.25%, and said it would not rule out a further hike later this year. The country’s inflation rate registered at 2.8% in June, remaining unchanged from the month prior.

July’s biggest mover was the yield on Greece’s 10-year benchmark note, which fell by more than 42 basis points to 3.32%. Its Italian equivalent was a close second, finishing the month at 3.61%. Italy’s annual inflation rate rose to 1.3% from 0.8% in June, while the consumer confidence indicator increased to 98.9 points in July from 98.3 points in the previous month. Elsewhere in the Euro area, France’s 10-year government bond mid-yield closed nearly 30 basis points lower at 2.97% on July 31. The country’s inflation rate was measured at 2.3% in July, up slightly from 2.2% in June, while its GDP rose by 1.1% year-over-year in Q2 this year.

In contrast, Germany’s Q2 GDP contracted 0.1% year-over-year. The 10-year Bund mid-yield finished July 21 basis points lower at 2.28%. During the same month, inflation increased slightly to 2.3% from 2.2% in June, while the HCOB Germany Manufacturing PMI fell to 43.2.

Continuing the busy period for elections seen in June, the Labour Party secured a victory in the UK’s general election on July 4, with Keir Starmer replacing the Conservative’s Rishi Sunak as Prime Minister. The country’s 10-year Gilt mid-yield closed the month at 3.98%, down 20 basis points from 4.18% in June. The GfK Consumer Confidence Index rose to -13 from -14 the month prior, while the S&P Global/CIPS UK Manufacturing PMI also ticked higher to 51.8 compared to 50.9 in June.

On July 21, current U.S. President Joe Biden announced he was ending his re-election campaign and endorsed Vice-President Kamala Harris as the Democratic candidate to run against the Republican party’s Donald Trump. The yield on the U.S. 10-year Treasury fell 30 basis points to 4.10% in July, while the annual inflation rate in the country slowed to 3% in June.

Across the border, the Canadian 10-year benchmark note mid-yield dropped by more than 33 basis points to 3.16%. On July 24, the Bank of Canada trimmed its interest rate to 4.5% for the second consecutive month. The country’s inflation rate fell to 2.7% in June from 2.9% in May.

Related Content

Tradeweb Government Bond Update – June 2024