Tradeweb Government Bond Update – January 2025

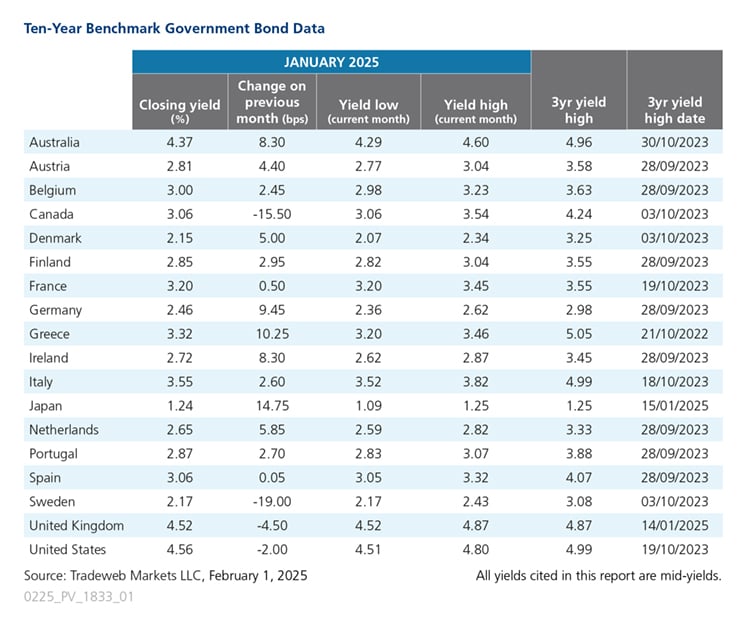

January was a mixed month for global government debt markets, with yields both increasing and decreasing across the board. Starting in the U.S., Donald Trump was sworn in as the 47th U.S. President on January 20. The annual inflation rate rose for the third consecutive month to 2.9%, while the Federal Reserve voted to keep interest rates unchanged at 4.25%. The U.S. 10-year Treasury mid-yield went down by 2 basis points to close the month at 4.56%.

Casey Costanza, Director, U.S. Treasuries Product Manager, said: “Last year’s volatility continued well into 2025, and trading activity in U.S. Treasuries dominated headlines throughout January. In a month that saw a new Republican President take office in the U.S., the mid-yield on the U.S. 10-year Treasury reached a month-high of 4.8% on January 13. The last time the benchmark note’s yield reached this level was October 31, 2023.”

In contrast to its U.S. counterpart, the Bank of Canada voted to cut interest rates by 25 basis points to 3% on January 29. The Canadian 10-year benchmark note saw its mid-yield decrease by almost 16 basis points to end the month at 3.06%. The country’s annual inflation rate fell to 1.8% in December from 1.9% in the previous month.

However, the month’s biggest mover was Sweden’s 10-year government bond, whose mid-yield dropped by 19 basis points to 2.17%. The country’s central bank, Riksbank, cut its interest rate by 25 basis points to 2.25% during its January meeting, and inflation fell to 0.8% in December from 1.6% the prior month, the lowest level in four years.

The European Central Bank voted in its first meeting of the year to cut interest rates to 2.75% for the fifth time since June 2024. At month end, the German 10-year Bund mid-yield registered at 2.46%, nearly 10 basis points higher than December’s figure. Germany's annual inflation rate fell to 2.3% in January, down from 2.6% the month prior, and the HCOB Germany Manufacturing PMI rose to 45 in January from 42.5 in December.

Elsewhere in Europe, the mid-yield on the French 10-year government bond rose by less than one basis point to 3.2% in January. France's annual inflation rate increased slightly to 1.4% in January from 1.3% the month prior. Over in Italy, the yield on the 10-year benchmark bond rose 3 basis points to 3.55%. Similarly, the annual inflation rate increased to 1.5% in January from 1.3% in the previous two months.

In the UK, the 10-year Gilt mid-yield fell by 5 basis points to 4.52% at month-end. On January 14, the benchmark note reached a three-year yield high of 4.87%. Inflation in the country edged lower to 2.5% in December from 2.6% in November, and the GfK Consumer Confidence dropped by 5 points to -22 in January, the lowest figure since November 2023. The S&P Global UK Manufacturing PMI rose to 48.3 in the same month, up from an 11-month low of 47 in December.

Moving to Asia Pacific, the Australian 10-year government bond mid-yield fell by 8 basis points to 4.37%. Australia's annual inflation rate fell to 2.4% in the last quarter of 2024, down from 2.8% in Q3 and marking the lowest reading since Q1 2021.

Japan’s 10-year benchmark bond mid-yield climbed by nearly 15 basis points to 1.24% at the end of the month, and also reached a three-year yield high of 1.25% on January 15. At its latest meeting, the Bank of Japan raised its short-term policy target to 0.5% from 0.25%. The country’s annual inflation rate jumped to 3.6% in December from 2.9% in the month before, marking the highest reading since January 2023.

Related Content