Tradeweb Government Bond Update – February 2025

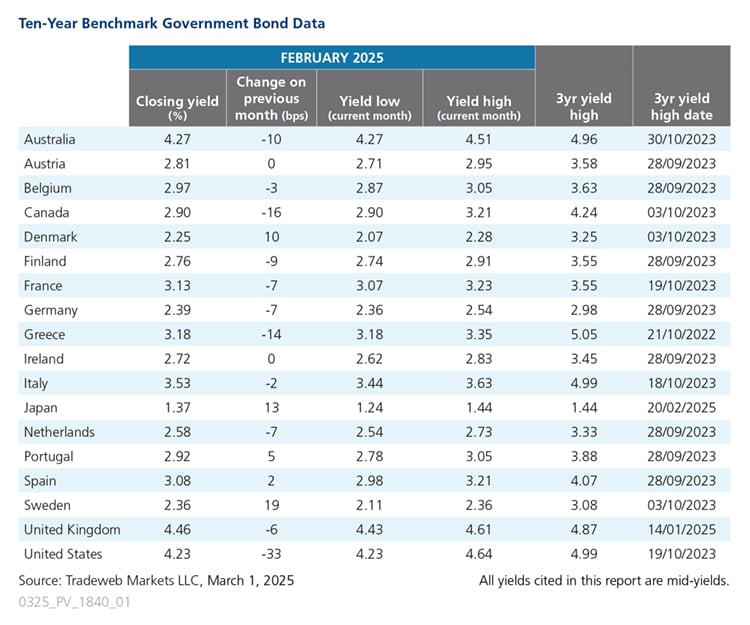

It was another mixed month for global government debt markets, with yields both increasing and decreasing across the board in February. Beginning in Asia Pacific, the mid-yield on Japan’s 10-year benchmark bond climbed 13 basis points during the month to close at 1.37%.

Taichi Shibuya, Head of Japan at Tradeweb, said: “The Japanese 10-year government bond mid-yield continues to trend upward, and on February 20, reached another three-year yield high of 1.44%. After the Bank of Japan signalled more rises to interest rates this year at its previous meeting, the country’s Core Consumer Price Index (CPI) rate increased for the third consecutive month to 3.2% in January, marking the highest reading since June 2023.”

The yield on the Australian 10-year benchmark bond dropped 10 basis points to 4.27% at month-end. On February 18, the Reserve Bank of Australia lowered the cash rate target by 25 basis points to 4.1%. Australia's Westpac-Melbourne Institute Consumer Sentiment Index rose slightly to 92.2 in February from 92.1 in the month prior.

Across the Pacific, the U.S. 10-year Treasury mid-yield fell by 33 basis points to 4.23%, the largest move in February. The U.S. economy added 143,000 jobs in January, significantly below the 307,000 added in the month before, while the annual inflation rate edged up to 3% in the same month from 2.9% in December.

Similarly, in neighbouring Canada, the country’s inflation rate rose by 0.1% to 1.9% in January, but still remained below the Bank of Canada’s midpoint target of 2% for the sixth consecutive month. The Canadian 10-year benchmark bond yield fell by 16 basis points to 2.9%. Meanwhile, the S&P Global Canada Manufacturing PMI fell to 47.8 in February from 51.6 in the previous month, marking the first decline since August of last year.

Over in Europe, the German 10-year Bund mid-yield finished the month seven basis points lower at 2.39%. Germany's annual inflation rate remained unchanged at 2.3% in February, and the HCOB Germany Manufacturing PMI climbed once again to 46.5 in February from January’s figure of 45. In France, the annual inflation rate fell sharply to 0.8% in February from 1.7% in January, the lowest reading since February 2021. The mid-yield on the country’s 10-year government bond decreased by seven basis points to 3.13% at month-close.

Italy’s 10-year benchmark note yield fell just two basis points over the month to 3.53%. The Italian Consumer Confidence Index increased to 98.8 in February from 98.2 in January, the highest figure in seven months, while the annual inflation rate rose to its highest reading since September 2023 at 1.7%.

In the UK, the 10-year Gilt mid-yield declined by six basis points to 4.46% at the end of February. On February 6, the Bank of England voted by a majority of 7–2 to reduce interest rates by 25 basis points to 4.5%. Inflation in the country rose to 3% in January from 2.5% in December, and the GfK Consumer Confidence increased by two points to -20 in February. The S&P Global UK Manufacturing PMI fell to 46.9 in the same month from 48.3 in January.

Related Content

Tradeweb Government Bond Update – January 2025