Tradeweb Government Bond Update – December 2024

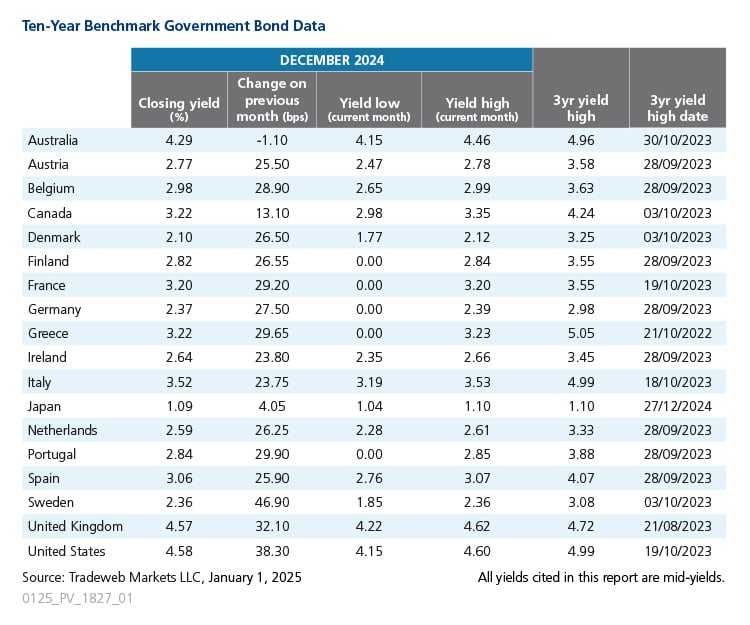

December saw a sell-off in global government debt markets, with yields on 10-year benchmark notes increasing across the board, aside those for Australia.

Beginning in France, the mid-yield on the country’s 10-year government bond rose by almost 30 basis points to close the year at 3.2%. On December 4, French Prime Minister Michel Barnier lost a no-confidence vote. “There were no significant changes in the OAT volume traded on Tradeweb in the week following the no-confidence vote, dropping by just one percentage point to 25% of all EUR Government Bonds notional volume executed. This illustrates robust, liquid electronic markets that continue to be well-functioning during volatile conditions,” said Roderick Joniaux, Head of European Government & Supranational Products at Tradeweb.

Joniaux continued: “Similarly, the German Chancellor Olaf Scholz lost a vote of confidence in mid-December. In the same week, the yield-spread between the French and German 10-year benchmark notes climbed to 80 basis points from 55 basis points at the start of the year.”

The German 10-year Bund mid-yield registered at 2.37% at year-end, rising by 28 basis points from the month prior. The HCOB Germany Manufacturing PMI was confirmed at 42.5 in December, down slightly from 43 in the previous month. Germany’s annual inflation rate increased to 2.2% in November, up from 2% in October and the highest rate in four months.

On December 28, Prime Minister Giorgia Meloni’s deficit-cutting budget for 2025 was approved by the Italian Senate, which involves plans to reduce the fiscal deficit to 3.3% of GDP from 3.8% projected last year, while cutting taxes for low and middle-income brackets. The Italian 10-year benchmark note yield climbed 24 basis points to end December at 3.52%. The annual inflation rate accelerated to 1.3% in November from 0.9% in the prior month.

Elsewhere in Europe, the UK 10-year Gilt mid-yield increased by 32 basis points in December to 4.57%, while the Bank of England decided on December 19 to maintain interest rate at 4.75%. The country’s annual inflation rate edged up for the second consecutive month to 2.6% in November from 2.3% in October. The GfK Consumer Confidence indicator rose by one point from -18 in November to -17 in December, marking the second month of improvement. In the same month, the S&P Global UK Manufacturing PMI fell to an 11-month low of 47, down from November’s 48.

In contrast to its UK counterpart, the Federal Reserve voted on December 18 to decrease interest rates by 25 basis points to 4.25%. The U.S. 10-year Treasury mid-yield rose by 38 basis points to 4.58% at month-end, while the inflation rate in the U.S. registered slightly higher in November at 2.7% from 2.6% in the previous month.

In neighbouring Canada, the country’s central bank cut interest rates by 50 basis points to 3.25% for a second consecutive meeting on December 11. The country’s 10-year government bond mid-yield rose by 13 basis points to 3.22%. Canada’s annual inflation rate eased slightly to 1.9% in November from 2% in October.

Moving to Asia Pacific, Japan’s 10-year benchmark bond mid-yield climbed by four basis points to 1.09%. The annual inflation rate in Japan jumped to 2.9% in November from 2.3% in the month prior, marking the highest reading since October 2023. Over in Australia, the 10-year government bond mid-yield fell by one basis point to 4.29% at the end of December. In the same month, the Westpac Melbourne Institute Consumer Sentiment Index dipped by 2.2% to 92.8 from 94.6 in November.

Related Content