Tradeweb Government Bond Update - February 2021

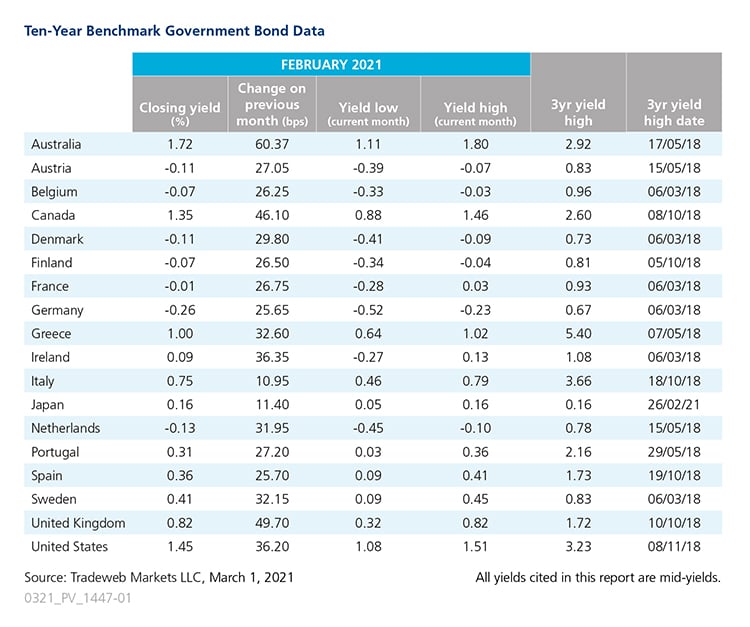

Amid ongoing debates about fiscal and monetary policy in February, global sovereign debt markets experienced a widespread sell-off for the second consecutive month. Ten-year government bond mid-yields increased across the board, with those for Australia climbing by more than 60 basis points to 1.72%, their highest closing value since early May 2019. At its February meeting, the country’s central bank decided to extend its bond purchases by an additional AUD 100 billion, when the current quantitative easing program is completed in mid-April.

The UK 10-year Gilt yield also saw a sharp rise of nearly 50 basis points to end the month at 0.82%. The Bank of England’s Monetary Policy Committee voted unanimously to maintain interest rates at 0.1% and the total target stock of asset purchases at GBP 895 billion. UK GDP shrank by a record 9.9% last year, the largest annual decline on record. Meanwhile, Germany’s 10-year Bund yield still finished February in negative territory at -0.26%, despite an increase of 26 basis points. According to revised figures from the Federal Statistical Office (Destatis), the country’s economy contracted by 4.9% in 2020, slightly better than a preliminary estimate of a 5.3% drop.

However, the largest yield move in the Euro area came from the Irish 10-year benchmark note. Beginning the month in negative territory at -0.27%, its mid-yield rose 36 basis points to end at 0.09%. Data released by the European Commission showed that Ireland was the only EU economy to grow in 2020, expanding by 3% compared to an average fall of 6.3% in the European Union and 6.8% in the Euro area, respectively. Italy’s 10-year bond yield saw the smallest move among its EU counterparts, increasing by nearly 11 basis points to close at 0.75%. Mario Draghi was sworn as the country’s new prime minister on February 13, after securing backing across political groups.

In Japan, the 10-year government bond yield climbed 11 basis points to finish at 0.16%, its highest closing point since January 2016, when the country’s central bank began its aggressive monetary policy moves. Japanese GDP decreased by 4.8% last year, its first contraction since 2009. After crossing the 1% threshold in January, the yield on the U.S. 10-year Treasury rose by another 36 basis points to end February at 1.45%. The U.S. economy shrank by 3.5% in 2020, its worst decline in 74 years. Minutes from the Federal Reserve’s latest meeting confirmed the central bank’s commitment to using its full range of tools to achieve its goals of maximum employment and inflation at the rate of 2% over the longer run.