Tradeweb Exchange-Traded Funds Update – September 2024

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 58.3 billion in September, the highest figure so far this year. The percentage of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool amounted to a platform record of 89.0%, while the proportion of AiEX volume was 21.9%.

Adam Gould, Global Head of Equities at Tradeweb, said: “We had another strong performing quarter on our European platform, with trading activity totalling EUR 163.3 billion, an increase of 28.2% compared to the same period last year. Meanwhile, September trading volume increased by 32.5% year-over-year, and there was an all-time high percentage of automated transactions.”

Volume breakdown

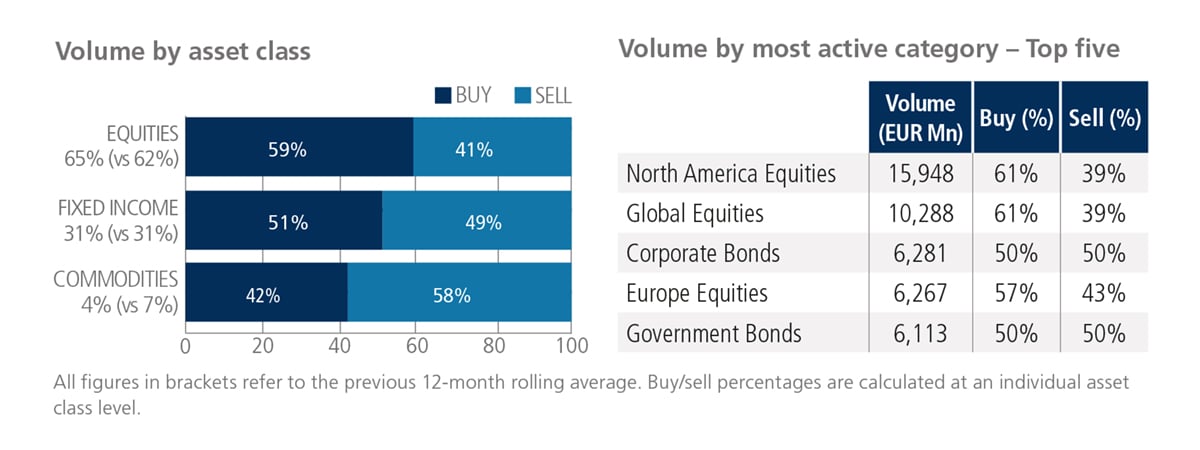

Fixed income- and equity-based ETFs saw net buying, while ‘sells’ exceeded ‘buys’ by 16 percentage points in commodity ETFs. Trading activity in equity ETFs decreased slightly to 65% of the overall platform flow from 66% the month prior, while their fixed income and commodity counterparts were at 31% and 4%, respectively. North America Equities was once again the most heavily-traded ETF category, with nearly EUR 16 billion traded over the month.

Top ten by traded notional volume

Eight of the top ten ETFs by traded notional volume were equity-based products. The iShares $ Corporate Bond UCITS ETF moved up one place to hold September’s top spot, while the iShares $ Corporate Bond UCITS ETF dropped to second.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in September reached USD 59.3 billion.

Adam Gould, Global Head of Equities at Tradeweb, said: “Trading activity on our U.S.-listed ETF platform increased by 22.3% compared to last September, driven by a wide range of clients using an expanded set of trading functionalities across the platform. This quarter saw total trading volume in the U.S. amount to USD 178.3 billion, an increase of 18.5% year-over-year.”

Volume breakdown

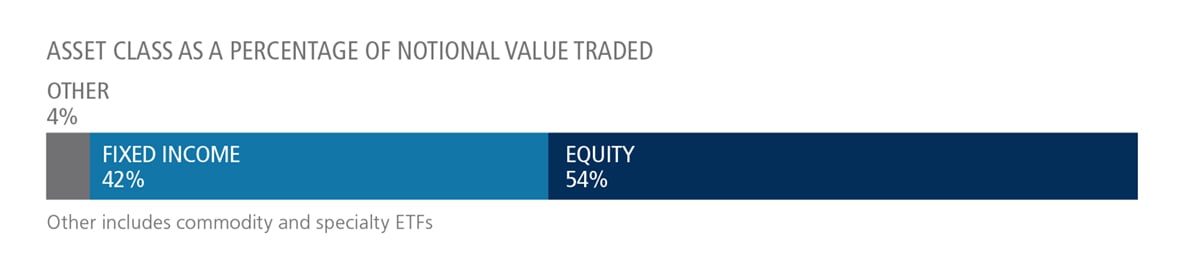

As a percentage of total notional value, equities accounted for 54% and fixed income for 42%, with the remainder comprising commodity and specialty ETFs.

Top ten by traded notional volume

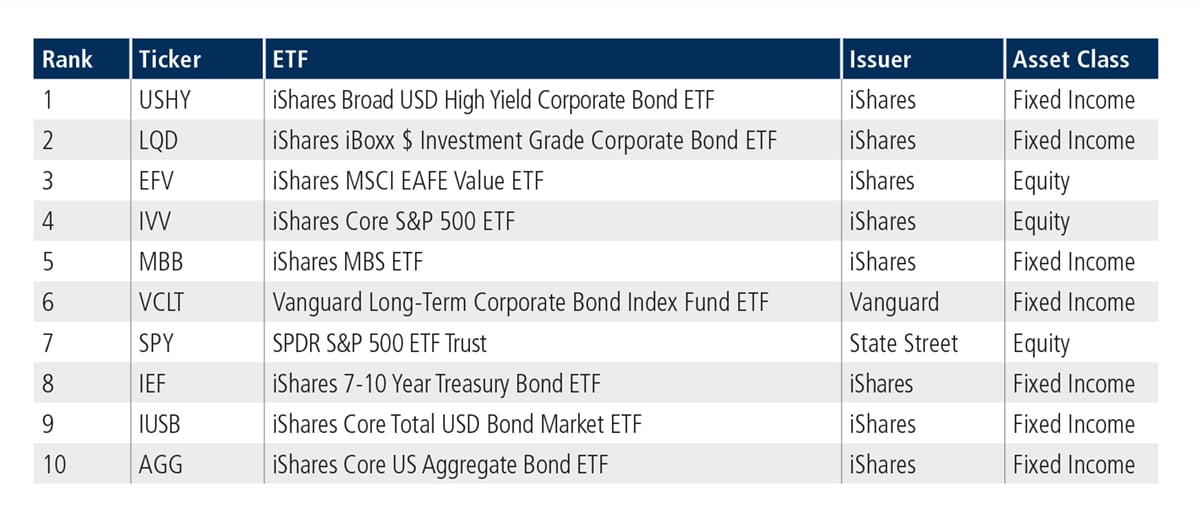

Seven of the ten most actively-traded ETFs in September were fixed income-based, with the iShares Broad USD High Yield Corporate Bond ETF moving up two places from August to be ranked first this month.

Related Content

Tradeweb Exchange-Traded Funds Update – August 2024