Tradeweb Exchange-Traded Funds Update – November 2024

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace amounted to EUR 64 billion in November, the platform’s best monthly performance this year so far. The proportion of transactions executed via Tradeweb’s Automated Intelligent Execution (AiEX) reached an all-time record of 90.7%, while the percentage of AiEX volume registered at 24.9%.

Adam Gould, Global Head of Equities at Tradeweb, said: “In November, institutional European ETF volumes grew by 17.8% year-over-year, reflecting continued strong growth on our marketplace. We had another record proportion of transactions processed via AiEX, as clients increasingly turn to automation, not only to achieve time and cost efficiencies, but also to navigate volatile market conditions.”

Volume breakdown

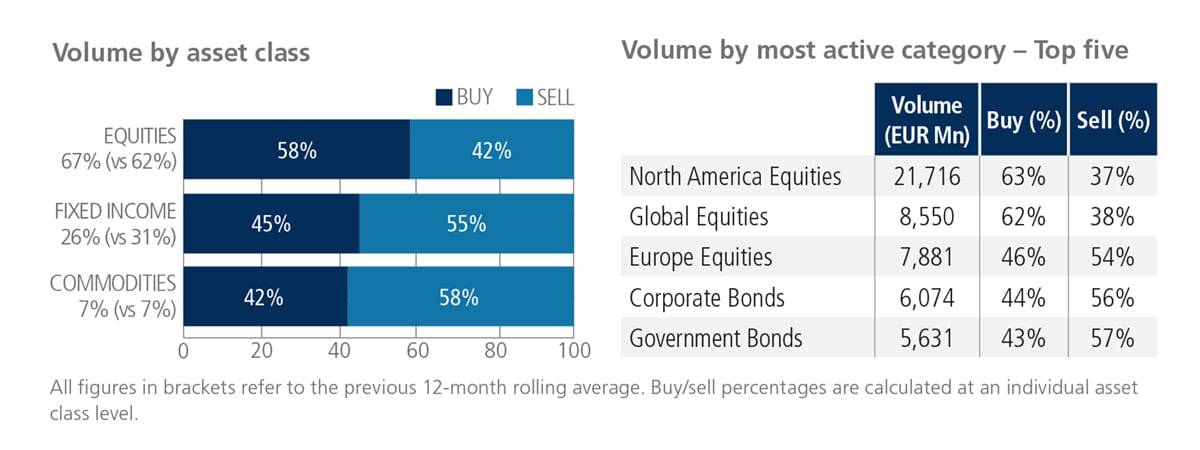

Equity ETFs were the only asset class to see net buying in November. Conversely, ‘sells’ exceeded ‘buys’ in fixed income and commodity-based products by 10 and 16 percentage points, respectively.

North America Equities was once again the most heavily-traded ETF category, with over EUR 21 billion traded over the month, more than double that of Global Equities. Both categories were mostly bought in contrast to their Europe Equities

Top ten by traded notional volume

Equity products accounted for seven of November’s ten most actively-traded ETFs, with the iShares Core S&P 500 UCITS ETF moving up two places from October to hold this month’s first spot. The iShares $ Corporate Bond UCITS ETF remained in second place, while the Deutsche Boerse Commodities Xetra-Gold ETC came in third.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in November reached USD 65.7 billion, the platform’s third best-performing month in 2024.

Adam Gould, Global Head of Equities at Tradeweb, said: “ETF volumes on Tradeweb were strong across regions this month, as investors reallocated portfolios following the U.S. election results. Institutional trading activity in U.S.-listed ETFs increased by nearly 16% year-over-year in November.”

Volume breakdown

As a percentage of total notional value, equities accounted for 56% and fixed income for 38%, with the remainder comprising commodity and specialty ETFs.

Top ten by traded notional volume

November’s ten most actively-traded ETFs in the U.S. mainly featured fixed income products. The iShares MBS ETF moved up from eighth place in October to claim this month’s top spot. The Vanguard Long-Term Treasury Index Fund ETF came in second, while the iShares Broad USD High Yield Corporate Bond ETF moved down one spot from the month prior to be ranked third.

Related Content

Tradeweb Exchange-Traded Funds Update – October 2024