Tradeweb Exchange-Traded Funds Update – January 2025

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace amounted to EUR 67.1 billion in January, the platform’s third best-performing month on record. The proportion of transactions executed via Tradeweb’s Automated Intelligent Execution (AiEX) reached another all-time record of 92.9%, while the percentage of AiEX volume registered at 25.9%.

Adam Gould, Global Head of Equities at Tradeweb, said: “Our European ETF platform had a strong start to the year, both in terms of total traded volume and adoption of automated workflows. AiEX continues to be the automated trading solution of choice for clients looking to optimise and scale their ETF trading activity.”

Volume breakdown

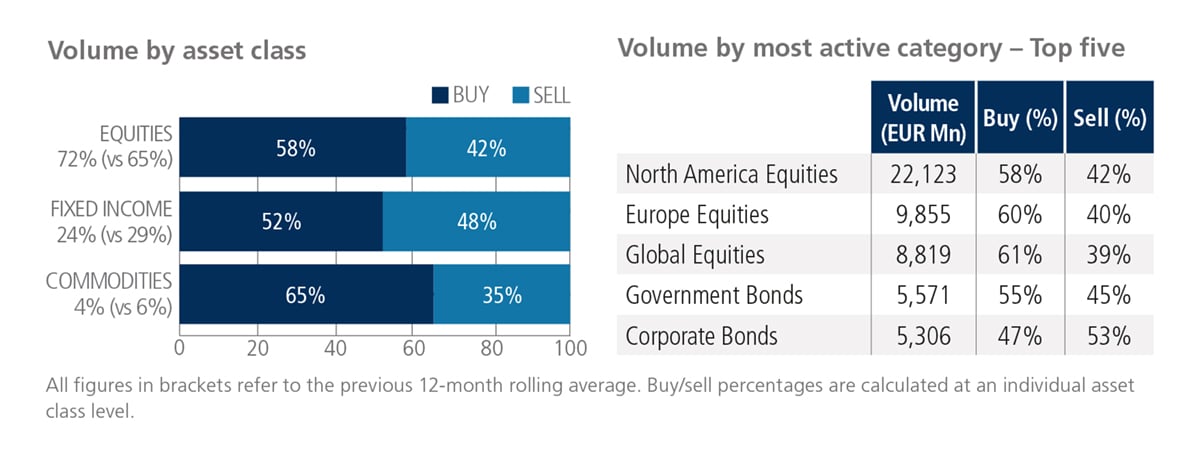

All ETF asset classes saw net buying in January and particularly Commodities, where ‘buys’ exceeded ‘sells’ by 30 percentage points. Overall activity in equity-based products increased to 72% of the total platform flow, beating the previous 12-month rolling average by seven percentage points

North America Equities was once again the most heavily-traded ETF category, with over EUR 22 billion traded over the month, more than double that of Europe Equities.

Top ten by traded notional volume

Equity products accounted for nine of the ten most actively-traded ETFs in January. The iShares MSCI USA ESG Screened UCITS ETF, which last appeared in the top ten table in December 2019, held the first place, while the UBS S&P 500 ESG UCITS ETF took second. The iShares Core S&P 500 UCITS moved down two spots from December to place third during the month.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in January reached USD 59.9 billion.

Adam Gould, Global Head of Equities at Tradeweb, said: “It was another strong period for trading activity in institutional U.S. ETFs, as we are continuing to see investors embrace the asset class as a way to diversify their investment portfolios.”

Volume breakdown

As a percentage of total notional value, equities accounted for 61% and fixed income for 34%, with the remainder comprising commodity and specialty ETFs.

Top ten by traded notional volume

January’s ten most heavily-traded ETFs in the U.S. were split evenly between fixed income- and equity-based products. The iShares Core S&P 500 ETF, which last occupied the first spot in June 2024, topped the table this month. Meanwhile, the Vanguard 500 Index Fund ETF and the SPDR S&P 500 ETF took second and third place, respectively.

Related Content

Tradeweb Exchange-Traded Funds Update – December 2024