Tradeweb Exchange-Traded Funds Update – January 2020

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

January was the third strongest month for the Tradeweb European-listed ETF platform since its launch in 2012, with total traded volume reaching EUR 33 billion. During the month, more than 76% of transactions were processed via Tradeweb’s Automated Intelligent Execution tool (AiEX).

Adriano Pace, head of equities (Europe) at Tradeweb, said: “The platform had a solid start to the year. January’s total notional volume was up 17% year-over-year and 8% month-over-month, while adoption of automated trading workflows remained high thanks to the operational efficiency, improved pricing, and auditability benefits it offers our ETF client base.”

Volume breakdown

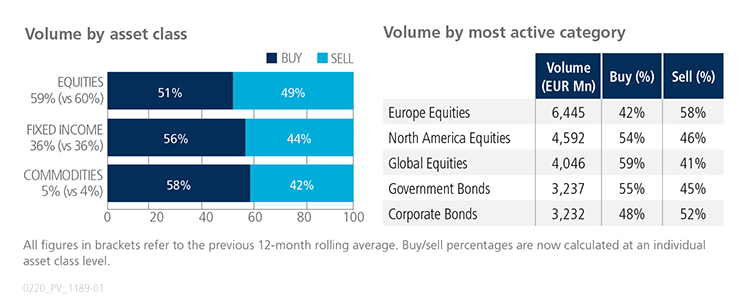

All ETF asset classes saw net buying for the second consecutive month. Trading activity in fixed income ETFs amounted to 36% of the overall platform flow, mirroring the previous 12-month rolling average. Nearly EUR 6.5 billion in notional volume was executed in Europe Equities ETFs. ‘Buys’ in the category lagged ‘sells’ by 16 percentage points.

Top ten by traded notional volume

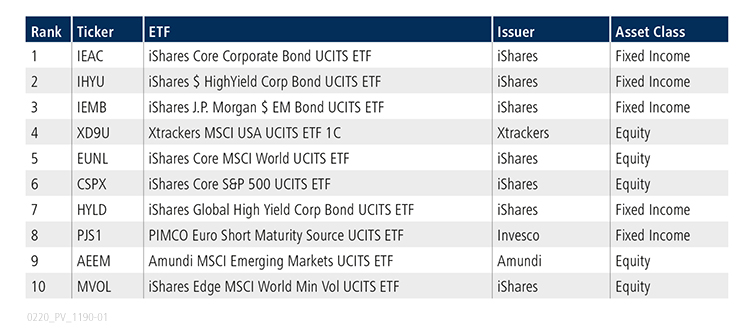

The iShares Core Corporate Bond UCITS ETF proved to be January’s most actively-traded instrument on Tradeweb’s European ETF platform, after last occupying the top spot in September 2019.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in January 2020 was just over USD 15 billion.

Volume breakdown

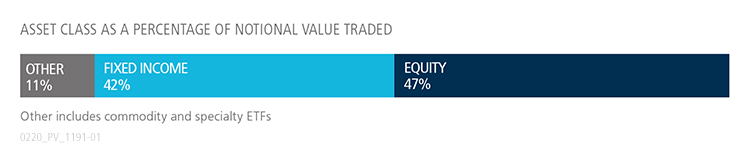

As a percentage of total notional value, equities accounted for 47% and fixed income for 42%, with the remainder comprising commodity and specialty ETFs. The proportion of U.S. ETF trades executed on the platform via the Tradeweb AiEX tool surpassed 56%.

Top ten by traded notional volume

During January, 737 unique tickers traded on Tradeweb’s U.S. ETF platform. Two products offering exposure to higher rated environmental, social, and governance (ESG) companies were among the month’s ten most heavily-traded ETFs. The iShares ESG MSCI USA ETF and the iShares ESG MSCI EM ETF both hold an ‘A’ MSCI ESG Rating.

Adam Gould, head of U.S. equities at Tradeweb, said: “Not one, but two ESG-focused ETFs made it to our top ten list by traded notional volume in January. Investors are increasingly looking to align their portfolios with sustainable strategies, and ETFs provide them with a transparent and cost-efficient way to achieve their ESG investment objectives.”