Tradeweb Exchange-Traded Funds Update – February 2025

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace amounted to EUR 70.3 billion in February, the platform’s third best-performing month on record. The proportion of transactions executed via Tradeweb’s Automated Intelligent Execution (AiEX) reached 92.5%, the second-highest figure recorded, while the percentage of AiEX volume registered at 25%.

Adam Gould, Global Head of Equities at Tradeweb, said: “Total traded volume on our European ETF platform in February increased by 25% year-over-year, reflecting another strong-performing month. We saw even more clients embracing our automated rules-based Request-for-Quote (RFQ) protocol, as they are increasing their institutional ETF trading activity.”

Volume breakdown

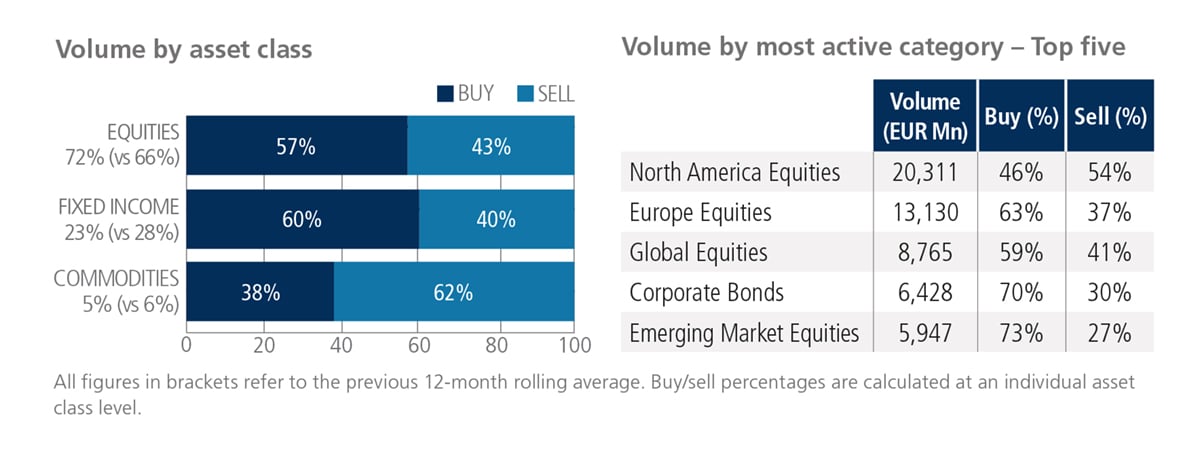

In February, equity- and fixed income-based products continued last month’s overall net-buying, whereas there was a reversal in this trend in commodities, with ‘sells’ exceeding ‘buys’ by 24 percentage points. Equities remained the most actively-traded ETF asset class, comprising 72% of overall platform flow, with over EUR 20 billion traded in the North America Equities ETF category over the month.

Adam Gould, Global Head of Equities at Tradeweb, commented: “ETFs offering exposure to North American Equities were the only shares-based category to see net-selling during February.”

Top ten by traded notional volume

Equity products accounted for eight of the ten most actively-traded ETFs in February. The iShares MSCI USA ESG Enhanced UCITS ETF moved up from seventh in January to hold this month’s first place, while the UBS LFS MSCI EMU UCITS ETF, which last appeared in the top three in July 2018, took the second spot. The iShares Core S&P 500 UCITS moved up three places to rank third during the month.

U.S.-LISTED ETFs

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in February reached USD 68.5 billion.

Adam Gould, Global Head of Equities at Tradeweb, said: “February was a busy month as the investment community continued to react to changing geopolitical developments, including a wide range of tariff proposals. Trading activity in institutional U.S. ETFs grew by 4% year-over-year, as clients look to this asset class to express short-term tactical views.”

Volume breakdown

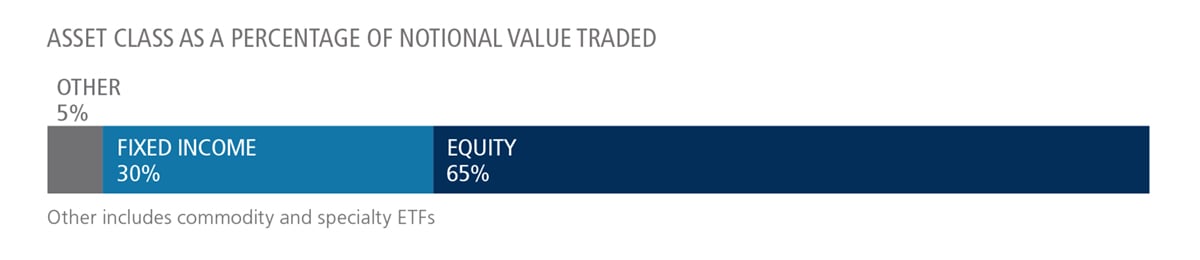

As a percentage of total notional value, equities accounted for 65% and fixed income for 30%, with the remainder comprising commodity and specialty ETFs.

Top ten by traded notional volume

Eight of February’s ten most heavily-traded ETFs in the U.S. were equity-based products, with the remainder being fixed income-based. The iShares Core S&P Mid-Cap ETF, which last appeared in first place in July 2023, occupied the table’s top spot in the month. The iShares Core S&P 500 ETF moved down one spot to be ranked second, while the iShares Core MSCI Emerging Markets ETF placed third.

Related Content