Tradeweb Exchange-Traded Funds Update – August 2024

The following data is derived from trading activity on the Tradeweb Markets institutional European- and U.S.-listed ETF platforms.

EUROPEAN-LISTED ETFs

Total traded volume

Trading activity on the Tradeweb European ETF marketplace reached EUR 55.2 billion in August. The percentage of transactions processed via Tradeweb’s Automated Intelligent Execution (AiEX) tool was a record 88.9%, while the proportion of AiEX volume amounted to 24.3%.

Adam Gould, Global Head of Equities at Tradeweb, said: “The summer of 2024 was anything but quiet for European ETF trading on Tradeweb. August proved to be particularly strong, with dealer-to-client total traded volume increasing by 39% year-over-year.”

Volume breakdown

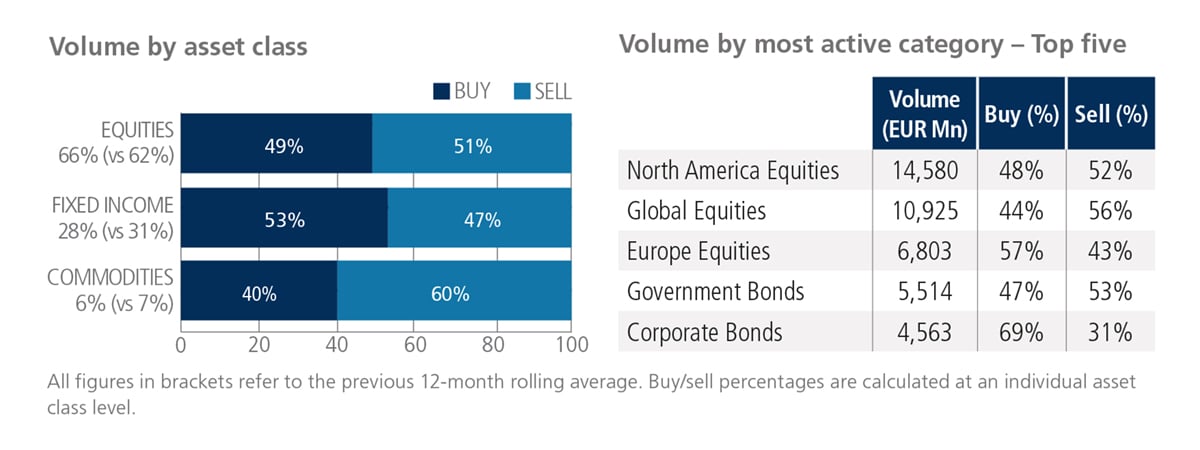

Fixed income ETFs saw net buying for the second consecutive month, with ‘buys’ in the asset class outpacing ‘sells’ by six percentage points. Conversely, equity and commodity-based products were mainly sold, and ‘buys’ in the latter lagged ‘sells’ by 20 percentage points. Trading activity in equity ETFs rose to 66% of the overall platform flow, while their fixed income and commodity counterparts were at 28% and 6%, respectively. North America Equities was once again the most heavily-traded ETF category, with nearly EUR 14.6 billion traded over the month.

Top ten by traded notional volume

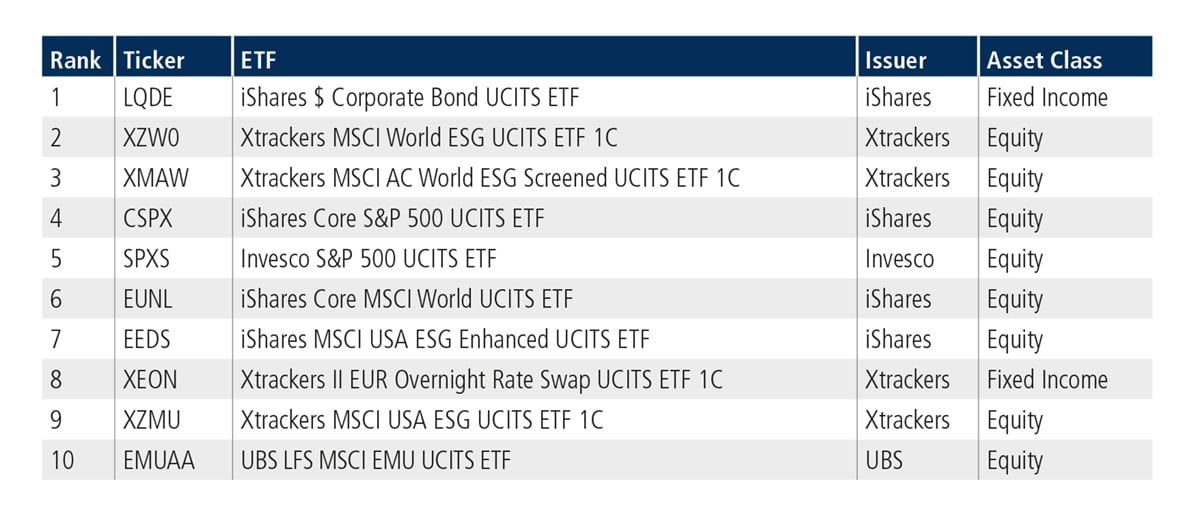

August’s top ten by traded notional volume comprised mainly shares-based products, and primarily ETFs offering investor exposure to U.S. and Global equities. However, the fixed income-based iShares $ Corporate Bond UCITS ETF held on to the top spot for the second month in a row.

U.S.-LISTED ETFs

Total traded volume

Total consolidated U.S. ETF notional value traded in August reached USD 62.5 billion.

Adam Gould, Global Head of Equities at Tradeweb, said: “The traditional summer lull did not materialise this year. August 2024 was by far the best-performing one in the history of our U.S. ETF platform. This is hardly surprising given the intense volatility markets have been experiencing, but also the continued adoption of RFQ trading by ETF institutional investors.”

Volume breakdown

As a percentage of total notional value, equities accounted for 56% and fixed income for 39%, with the remainder comprising commodity and specialty ETFs.

Top ten by traded notional volume

There were six fixed income products among August’s ten most actively-traded ETFs, with the Vanguard Long-Term Corporate Bond Index Fund ETF moving up three places from July to be ranked first.

Related Content