Portfolio Trading in 2024: Advancing Transparency and Efficiency in Credit Markets

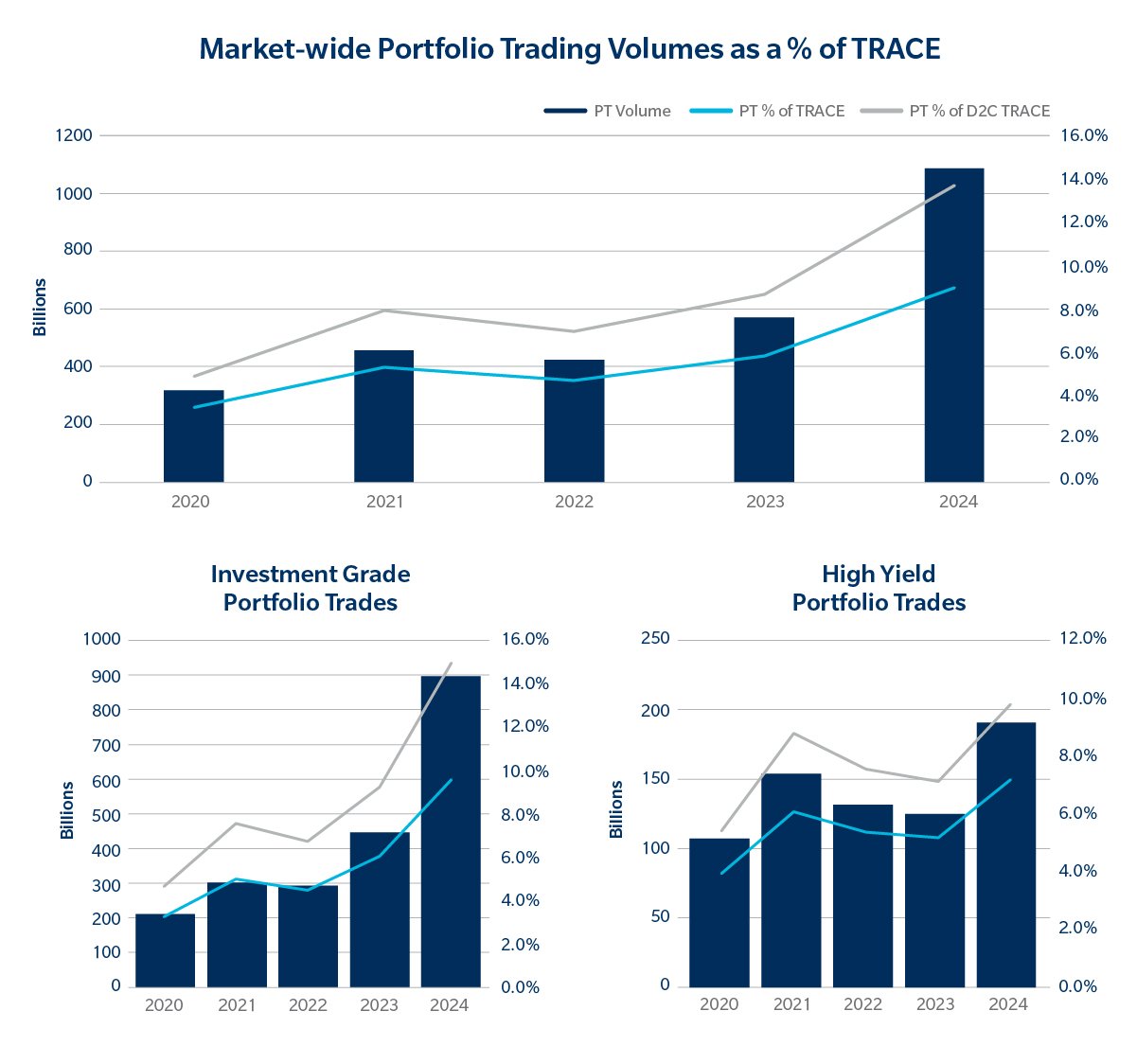

2024 was a landmark year for portfolio trading (PT), showcasing remarkable growth and evolution. In December, portfolio trading reached an industry record high, accounting for 11.4% of TRACE volume, including 17.5% of dealer-to-customer TRACE volume, marking the second time it crossed the double-digit barrier over a single month. This growth demonstrates the tool’s increasing value as clients continue to utilize it to fulfill their evolving mandates and execution needs.

Since Tradeweb introduced portfolio trading to the institutional market in 2019, portfolio trading has proved its resilience across various market cycles, from shifts in interest rate regimes and market volatility to periods of geopolitical uncertainty. Over the years, portfolio trading has continued to provide value to our clients regardless of the market environment, complementing the traditional request-for-quote (RFQ) protocol and enhancing the way our clients trade.

This growth trajectory, illustrated in the chart below using TRACE data, reflects increased adoption from new firms and expanded usage by existing clients, with the number of clients using portfolio trading on Tradeweb increasing by 21% in 2024 – the highest year-over-year (YOY) increase since 2021.

Source: TRACE data

Dealer Competitiveness and Improved Execution Quality

As portfolio trading matures, dealers are continuing to adapt to its growing prominence. Market makers now have specialized portfolio trading desks designed to price baskets with greater efficiency and competitiveness. This evolution can be seen by the improvement of client execution quality over time, as trades move closer toward Mid compared to previous years.

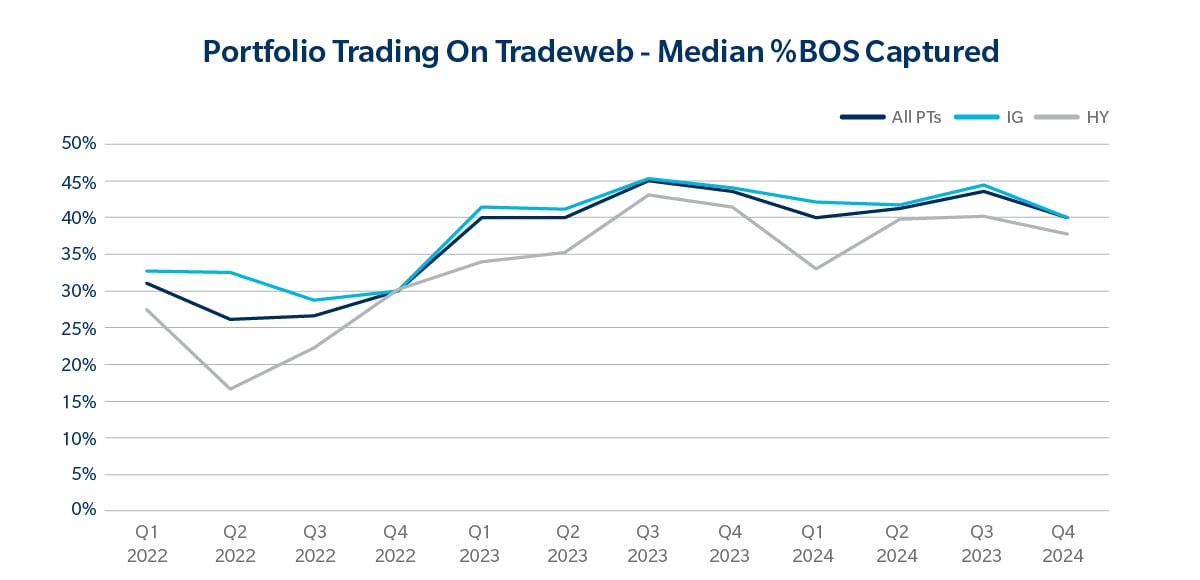

In the below chart, we highlight the quarterly percentage bid/offer spread (BOS%) performance for in-competition (in-comp) portfolio trades on Tradeweb. In this example, 0% represents paying the full bid/offer spread and 50% signifies execution at Mid point. Over time, median execution quality using PT has trended toward Mid and remained high as portfolio trading volumes grew in 2024.

Source: Tradeweb

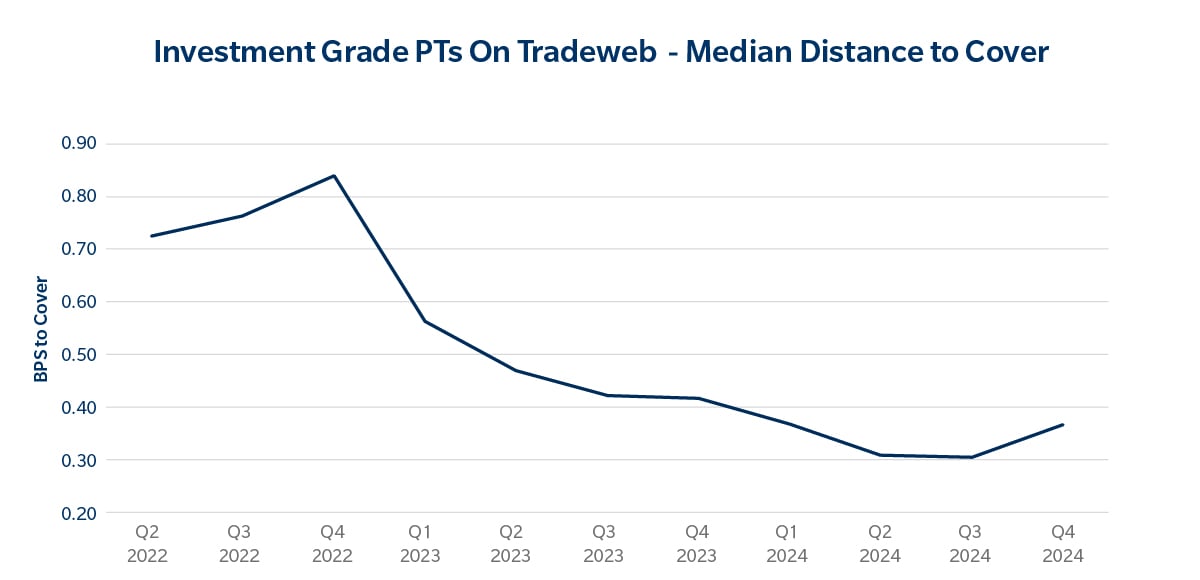

Additionally, the distance to cover, defined as the difference between the winning quote and the next best quote, for in-comp PTs has also significantly declined over time, indicating more transparency in the pricing of these baskets as well as increased market competitiveness. The below chart shows execution quality has improved since 2022, with multiple dealers now consistently quoting in that same high-quality ballpark.

Source: Tradeweb

Enhanced Transparency with New Pre-Trade Analytics

As discussed in my previous piece, Tradeweb’s leadership in the electronification of portfolio trading has resulted in rich insights and trade data into baskets pricing. Through our analysis of thousands of portfolio trades over dozens of attributes, we’ve seen how factors such as portfolio composition and market-driven conditions can significantly influence the total portfolio trading cost. Through the introduction of our pre-trade analytics tool, clients can now optimize execution quality by refining basket characteristics and timing trades effectively.

As discussed in my previous piece, Tradeweb’s leadership in the electronification of portfolio trading has resulted in rich insights and trade data into baskets pricing. Through our analysis of thousands of portfolio trades over dozens of attributes, we’ve seen how factors such as portfolio composition and market-driven conditions can significantly influence the total portfolio trading cost. Through the introduction of our pre-trade analytics tool, clients can now optimize execution quality by refining basket characteristics and timing trades effectively.

We recently launched these live pre-trade analytics directly within the trading ticket, allowing clients to estimate costs based on pre-defined basket characteristics and provide real-time insights into the LQD ETF and HYG premium/discount overlap. This analysis complements our more detailed line-by-line feature, which clients can download via a spreadsheet to refine portfolio construction and dealer selection.

Looking Ahead in 2025

As the U.S. enters a new political climate and potential shifts in monetary policy, Tradeweb remains committed to advancing the electronification of credit markets. Portfolio trading has evolved into a more transparent and efficient tool, thanks to new innovations like our pre-trade analytics tool. These advancements have empowered clients to build more confidence in portfolio trading, enabling them to price risk more efficiently and competitively, and have propelled portfolio trading to new heights, a trend we believe will continue in the years to come.

Simultaneously, as clients find more use cases for portfolio trading, Tradeweb continues to enhance our RFQ offering. With solutions like RFQ Edge and enhanced analytics, Tradeweb is dedicated to becoming a one-stop-shop solution for clients’ credit trading needs.

Related Content

Analyzing Execution Quality in Portfolio Trading