Electronification is Set to Grow in MBS Markets

This article originally appeared in Coalition Greenwich here.

Executive summary

The U.S. mortgage-backed securities (MBS) market is one of the largest and most liquid in the world. At the end of Q3 2024, $1.1 trillion MBS securities were issued—a 12.5% increase year over year. To put that figure in perspective relative to other fixed-income markets, $1.6 trillion in U.S. corporate bonds and $3.5 trillion in U.S. Treasury securities were also issued over the same period. MBS accounts for roughly 13% of all U.S. bond issuance.

From a trading vantage point, MBS products represent almost a quarter of the average daily volume of U.S. fixed-income trading.1 Although some products within the asset class are notoriously illiquid, and trading mechanisms are in need of modernization, tides are changing as investment professionals and traders alike embrace more electronification. This is particularly true in the trading of certain over-the-counter (OTC) mortgage products, such as specified pools, commercial mortgage-backed securities (CMBS), collateralized mortgage obligations (CMOs), asset-backed securities (ABS), and other areas where risk transfer has historically happened over the phone or via chat.

Fixed-income electronic trading has been evolving in dribs and drabs. For instance, only one-third of investment-grade corporates were traded electronically in 2020 versus about half today. We expect a jump in MBS electronification in the next few years motivated by similar forces—efficiency, enhanced transparency and evolving TRACE reporting requirements.2 Further, trading venues are improving their offerings to enable portfolio managers (PMs) and traders to create more streamlined workflows and electronify the trading process. These catalysts, coupled with buy-side demand for electronic liquidity and new liquidity providers—both bank and nonbank—ensure future progress.

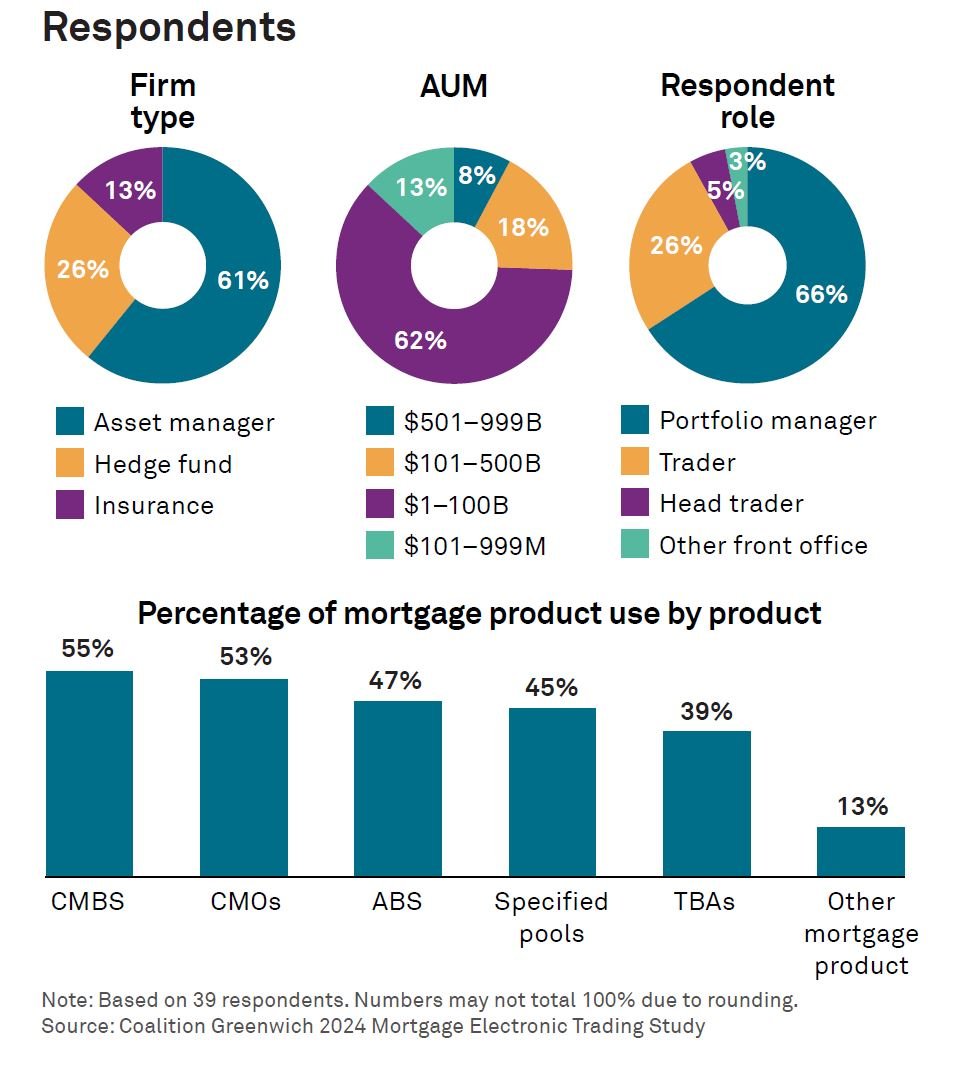

To better analyze these trends, Crisil Coalition Greenwich interviewed 39 U.S.-based mortgage traders at buy-side firms to understand the drivers and inhibitors of trade electronification, data needs, views on transparency, and the current state of mortgage market liquidity.

Key focus:

Based on our study findings, we believe sweeping changes will happen over the next five years in MBS trading and workflows, including:

- Automation of workflows will become a top priority for buy-side firms, enabling more electronification in MBS trading.

- Multidealer platforms (MDPs) will be the preferred way to transfer risk in a variety of MBS products currently being transacted via voice and/or chat.

- TRACE reporting will also play a role here, providing better data and price transparency.

- Growth and diversity of buy-side and sell-side market participation are anticipated as transparency improves from e-trading.

- Newer MBS products, such as exchange-traded funds (ETFs), will have a greater influence, similar to other markets.

Electronification set to help address MBS market challenges

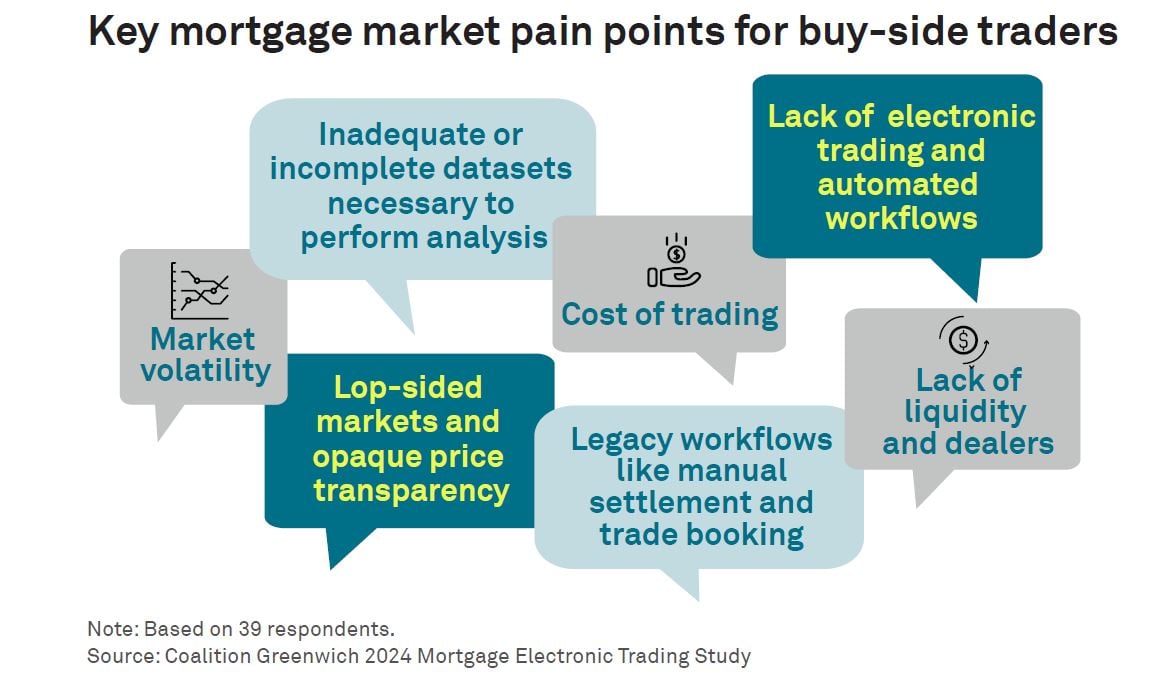

Buy-side professionals agree that more electronic trading in the mortgage market could be the solution for a number of challenges that PMs and traders face. For instance, study participants point to a dearth of liquidity and liquidity providers as key pain points—two areas that have been helped by greater transparency and liquidity in other products like credit. As with many OTC markets, there are data gaps for robust analysis and a lack of streamlined/standardized pre- to post-trade workflows. Most respondents agree on the following concerns:

Traders would love to see more accurate and actionable data—particularly on screens. One buy-side trader hopes illiquidity and fragmentation could diminish opaqueness in pricing—a common thread across our study participants. While some feel there simply isn’t enough transparency today to make this happen, there is positive sentiment about what the future might look like as traders shift away from legacy workflows and technology.

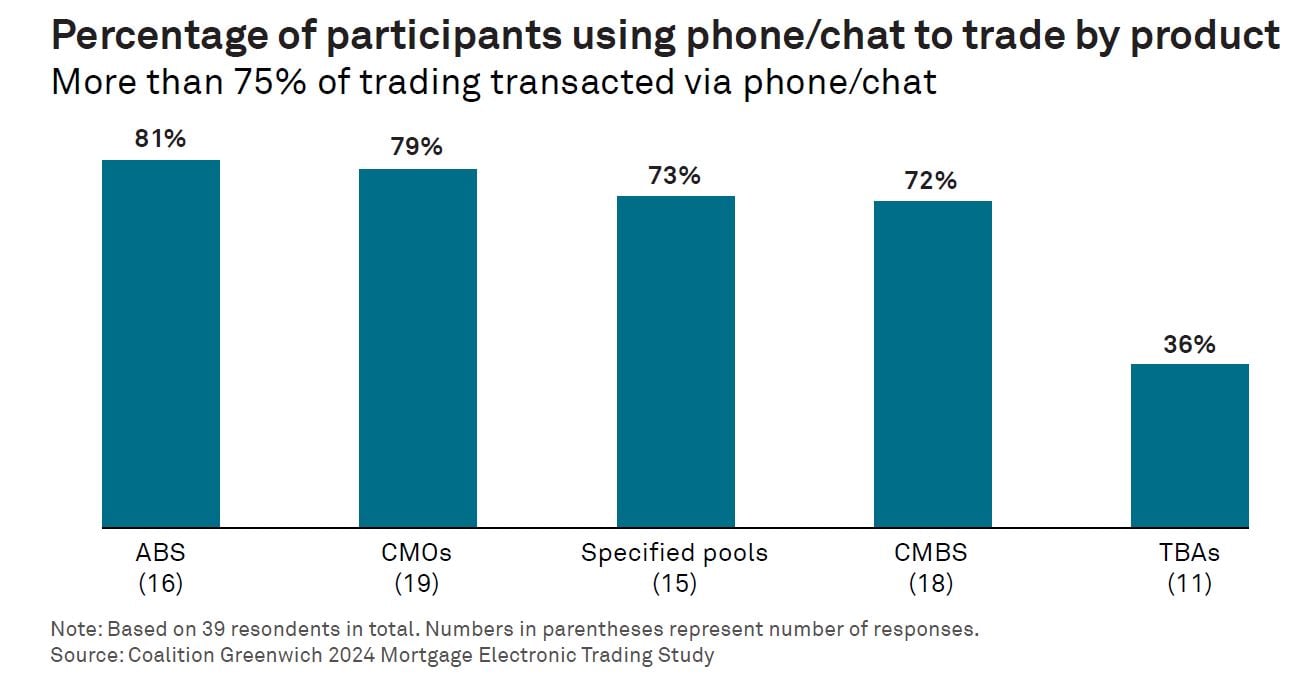

The state of MBS markets electronification

Although buy-side e-trading only exists in certain pockets of the mortgage market, participants are encouraged by the prospects of e-trading growth beyond TBAs (to-be-announced contracts). Most respondents execute over 75% of their ABS, CMO, specified pool, and CMBS trades via phone/chat. The existence of even a few firms pushing ahead with e-trading in these products suggests a positive trend—one that indicates much more is still to come.

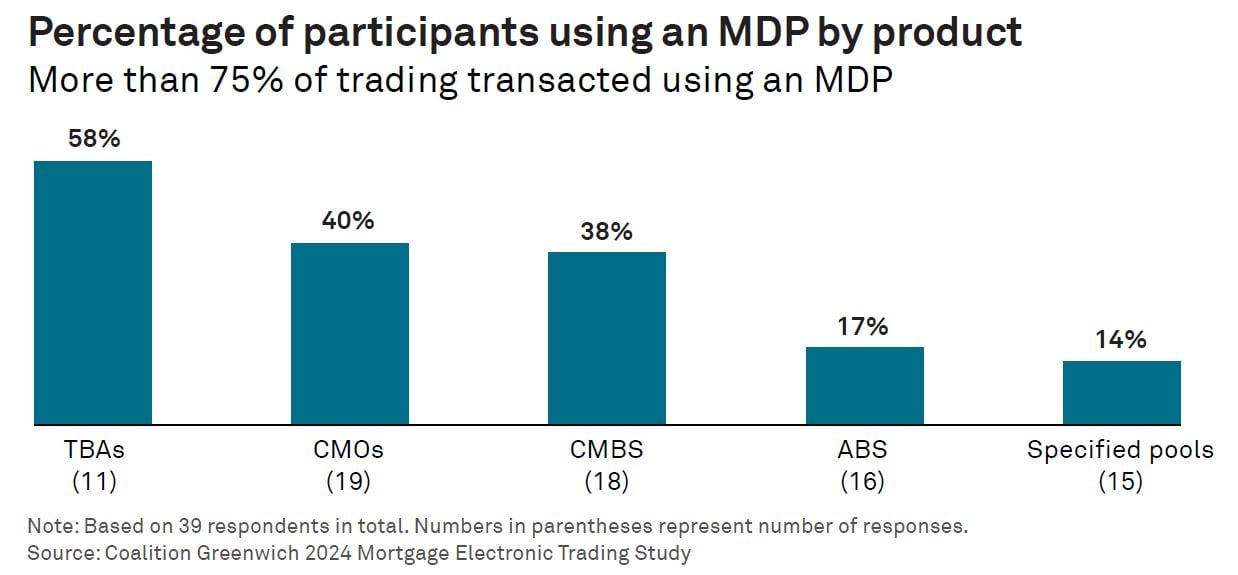

MDPs are becoming more important in MBS markets and are enhancing the adoption of e-trading. Broadly speaking, the growth of e-trading in markets that are typically considered illiquid, such as high-yield corporate bonds and municipal bonds, is a great testament to evolving market efficiency. It is evident that trading venue technology has reached a milestone where e-trading solutions exist that can work for nearly all OTC products, regardless of their liquidity profile.

A notable number of our study participants are trading via MDPs regularly. For instance, nearly 60% trade almost all of their TBAs via trading venues. About 40% are using MDPs to transact the majority of their CMO and CMBS orders. Active e-trading of ABS and specified pools is still limited to just a handful of traders in our study.

MDPs are the primary and often the only path toward more e-trading in the OTC fixed-income market. U.S. Treasuries are a great example of the link between MDPs and electronification as the majority are traded by the buy side using an MDP. E-trading is a natural fit in this case, given the liquidity of on-the-run Treasuries and other characteristics, including uniformity of securities and the infrastructure embedded into trading platforms and systems that are designed around them. In the MBS market, many of these features are also present, making products attractive for e-trading and automation.

Adjacent technology is necessary to enable more MBS e-trading. Many of the features and functionalities that traders rely on for order creation, price discovery, data, and analytics have been developed by trading venue firms as well as order management, portfolio management and execution management service providers (OMS, PMS, EMS). These capabilities help create consistency and transparency in securitized product characteristics—attractive attributes for e-trading. Buy-side professionals believe that other platform enhancements, including better pre-trade analytics and more on-screen liquidity, would also encourage more electronic volume.

While many technology providers offer these tools today, the entire MBS ecosystem needs to be on board with the shift to e-trading. For instance, about 50% of study participants are keen to see more sell-side providers offering on-screen liquidity to improve the amount and quality of pricing data. As this happens, there is a domino effect: Buyside traders will transfer more risk on the MDPs. This, in turn, will help attract additional liquidity providers and spur growth in the diversity of participants, creating a virtuous cycle.

Buy-side study participants aren’t shy when it comes to telling us what they need in order to grow their electronic MBS trading. While there is a long wish list, the majority of asks boil down to improved market structure, technology and data to move traders away from phones and chat. In most cases, the technology has already been built for other asset classes, as well as some fixed-income products, and can be leveraged for MBS.

What the buy side needs to increase MBS e-trading:

- Ability to attract more dealers

- Development of alternative ways to trade, such as interactive actions and protocols, as well as the ability to counter bids and offers more dynamically

- Inclusion of algo pricing and confirmation of best levels

- More integration with other up- and downstream systems for booking trades and managing positions and risk

- Incorporation of compliance requirements

- More pool information and other product-specific data

- Better UI/UX, ease-of-trading

Trade and workflow automation is improving

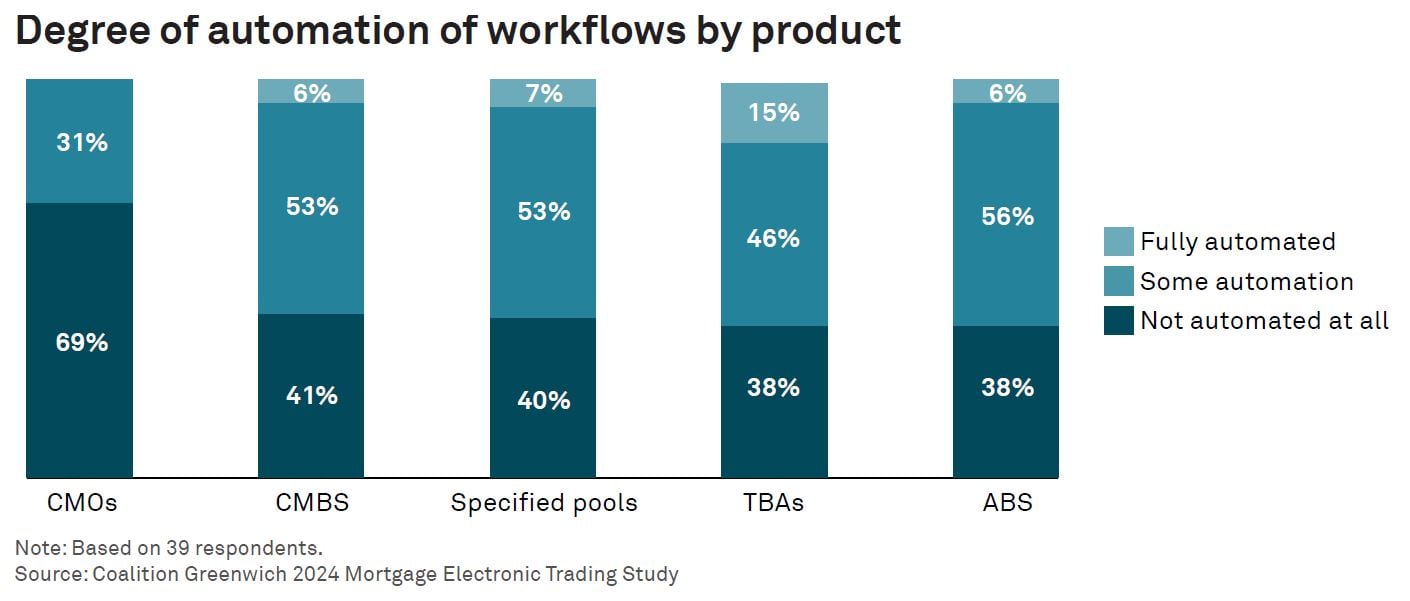

The use of automation is growing among traders on buy-side mortgage desks and will play a big part in driving more electronification. More than half of participants agree their trading workflow is at least somewhat automated, setting the stage for continued improvements and fewer high touches.

All participants in our study use an OMS and incorporate PMS and some EMS capabilities into their investing and trading process. Most third-party OMSs have gotten larger in recent years and cover more ground than ever before. In fact, nearly all OMS solutions providers now embed multi-asset trading tools, such as native access to different trading protocols, order creation, price discovery, compliance, and data and analytics capabilities. Request-for-quote (RFQ) orders can often be automatically generated and sent to fixed-income trading venues after portfolios are optimized and trades are approved.

On the execution front, analytics can be automatically generated to perform best execution analyses, examine dealer selection statistics and review historical prices. If no recent pricing is available, many participants are able to calculate and/or receive evaluative prices directly in their OMS from trading platforms and market data providers to integrate with other information. Once trades are executed, automation occurs further down the trade life cycle into the mid- and back-office processes to ensure accurate risk management, books of record and settlement.

MBS data and analytics are getting a bump from advanced technology

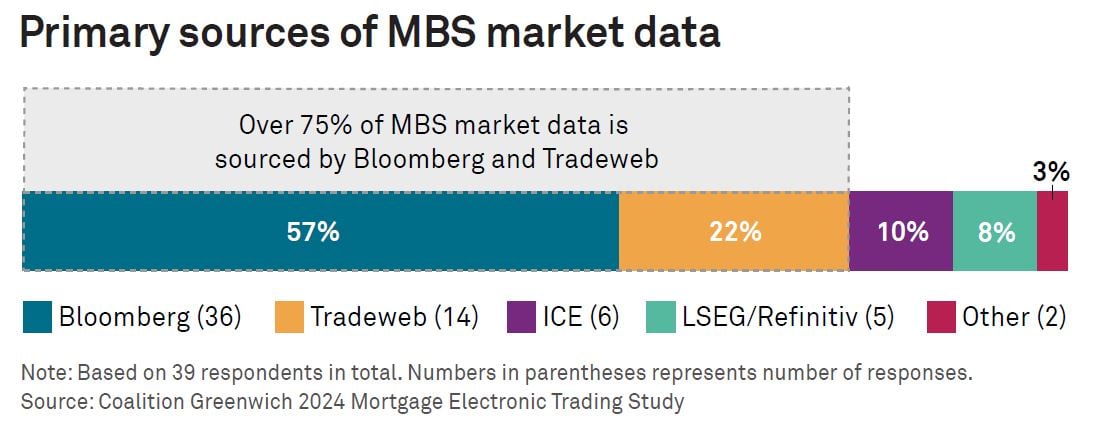

Buy-side professionals are clearly looking for improved data and analytics to underscore investment and trading in MBS markets. While there is considerably more data available to mortgage investors today than a decade ago, ingesting, analyzing and actioning that data remains a challenge. PMs and traders most often gather MBS data from numerous sources, including Bloomberg, ICE, LSEG, and Tradeweb. Aggregating and normalizing this data is no small feat. Buy-side respondents then utilize proprietary systems or turn to Intex, Trepp and Yieldbook models to help make decisions. In many cases, data and models can be used directly from an OMS.

Advanced technology, such as AI/ML and cloud compute power, is starting to change the way data is being consumed and used. Market participants are choosing APIs and even the cloud to consume information. This allows for better overall analytics, specifically pre-trade data—both encouraging factors leading to more growth in e-trading. According to one PM, the integration of advanced technology will afford investment teams with better pricing data and “real” executable levels.

Measuring best execution and utilizing transaction cost analysis (TCA) are priorities for over half of respondents who rely mainly on internal tools today—although third-party TCA use is growing. Those who aren’t using TCA point to difficulties in transparency and other market dynamics that make TCA difficult—a gripe that should diminish as more data and e-trading find their way to the mortgage market.

What will the future state of MBS trading look like?

Our buy-side study participants are optimistic about the evolution of the mortgage market. Over the next five years, the biggest changes to mortgage trading will center around expanding e-trading to more products, the availability of more real-time data supported by changing TRACE reporting requirements, analytics powered by advanced technology, and improved market liquidity via more market participants:

- Automation expands as it has in other parts of the fixed-income market. More automation is a top priority for buy-side professionals and an area we expect to see evolve quickly in the coming years. TRACE reporting requirements and higher volumes will be handled by the same number of traders, making more automation and straight-through-processing (STP) the only path forward. The resulting workflow efficiency will become a differentiator for some investors. Automated compliance checks, portfolio optimization, and electronic trading and reporting will further streamline workflows to ensure timely settlement and precise books of record and risk assessments.

-

Multidealer platforms will capture the vast majority of e-trading growth. There is a clear path toward more MDP use in the mortgage market. Today, about 43% of respondents trade less than one-quarter of their specified pool positions electronically. However, nearly the same number of participants (38%) believe they will trade more than three-quarters of their volume on a MDP in the future. These traders are keen to employ better technology around their trading decisions and embrace embedded pre-trade analytics, including TCA, pricing and other information. MDPs will continue to develop as extensions of OMS, PMS and EMS systems, becoming more integrated than ever as e-trading grows.

-

More market participation is expected due to enhanced liquidity, transparency and ease-of-trading. As technology expands and less liquid and opaque parts of the MBS market mature and become more electronic, greater participation is expected from traditional and non-traditional investors and traders. TRACE reporting will also play a role here, providing the data that so many participants who are investing and trading MBS crave. Retail investors could also find their way to the mortgage market, as institutional e-trading helps improve liquidity for wealth managers and supports the growth of mortgage products.

-

ETFs grow in size and influence the market, similar to other markets. The influence of ETFs has changed the way several markets in other asset classes are perceived in terms of pricing and liquidity. ETFs have also afforded transparency and liquidity to many fixed-income products that were previously illiquid and complex to invest in and trade. Over time, we expect the mortgage market to evolve in the same direction, as glimpses of this evolution are already in play.

-

More nonbank liquidity providers will step in. Similar to other markets traditionally quoted by banks and dealers, nonbank liquidity providers may also step into areas of MBS and provide liquidity, should price transparency and ease of trading materialize. The presence of nonbank liquidity providers is another sign of market maturity and stability.

METHODOLOGY

Between September and November 2024, Crisil Coalition Greenwich interviewed a total of 39 U.S. buy-side mortgage market participants to better understand the drivers of decision-making tied to the electronification of MBS markets. The majority of responses came from professionals working at asset management firms, with experts hailing from hedge funds and insurers making up the balance. Data and insights from Tradeweb, a multidealer platform, were also analyzed to better understand market liquidity and participation.

Assets under management (AUM) varied across participants. Looking across firm types, the distribution of roles was tilted toward portfolio managers, with traders and heads of trading accounting for about one-third of participation.