Electronic Trading Growth in Convertible Bonds

Originally appeared in a Coalition Greenwich report.

Executive Summary

Convertible bonds combine elements of bonds, stocks and derivatives, making them a unique asset class. Electronic trading has transformed the convertible bond market, driving improved execution quality, efficiency, and competition.

Coalition Greenwich research in 2020 examining the convertible bond market found that electronic trading had “wrought meaningful change, creating significant value for market participants.” In the years since, electronic trading adoption has accelerated, driving improved execution quality and additional efficiency for market participants.

An emphasis on best execution has led to increased interest in and use of multidealer platforms (MDPs). These electronic platforms provide a centralized hub for investors to compare prices across multiple dealers, increasing competition and driving down their trading costs.

About half of European convertible bond investors and nearly a fifth of their North American peers now trade U.S. convertible bonds electronically via MDPs. Additionally, 13% who aren’t currently utilizing electronic trading expect to do so in the next two years.

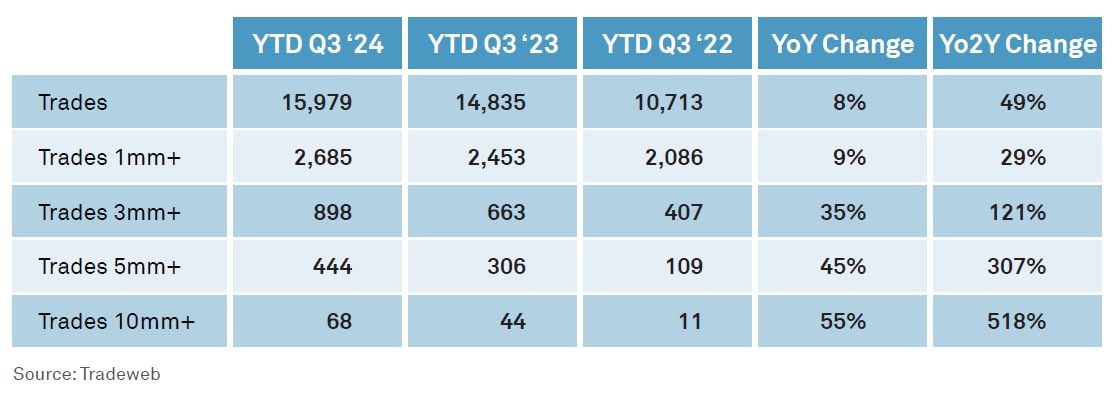

As traders become more comfortable with electronic trading, they’re starting to place larger orders. Trades over $5 million are growing over 45% year over year on Tradeweb, one of the largest MDPs for U.S. convertible bonds.

Electronic trading offers benefits beyond improved execution quality, including pre-trade transparency, real-time executable prices and automation of manual processes. Dealers are integrating their internal systems with MDPs, leveraging the “buy, build, and integrate” approach. Convertible bond traders are now demanding the same tools and automation as their colleagues in other asset classes. With the right incentives and tools, even less-liquid products like convertible bonds can be traded electronically.

Methodology

Between January and June 2024, Coalition Greenwich interviewed 141 investors at funds domiciled in North America and Europe that trade U.S. convertible bonds. Respondents were asked a series of questions about their activity in the U.S. convertibles market, including the proportion of convertibles volume executed via multidealer platforms, as well as key factors that are most important to the trader when deciding which broker to engage.

Data from Tradeweb, a multidealer platform operating an RFQ market for convertible bonds, was also analyzed to better understand market liquidity and participation.

Introduction

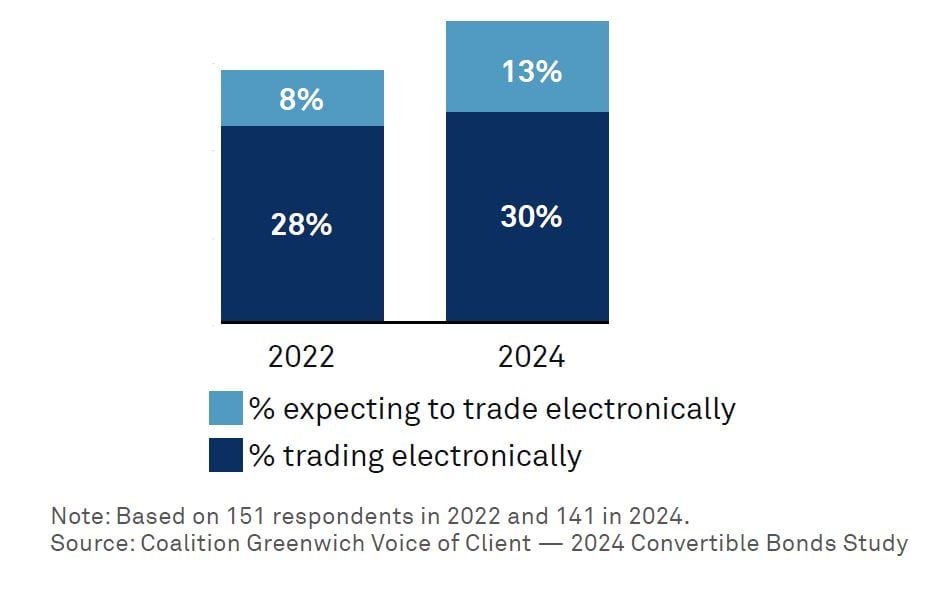

Convertible bond investors are increasingly adopting electronic trading. Coalition Greenwich data shows that in 2024, 30% of global convertible bond investors utilized electronic trading tools for at least some of their trades, up from 28% in 2022. Equally notable, 13% of non-users in 2024 expect to adopt electronic trading in the coming year, up from only 8% in 2022. And lastly, the average percentage of volume traded electronically by electronic traders also grew, from 31% in 2022 to 34% in 2024. While e-trading accounts for less than 10% of total market volume, these early adopters are out ahead of the pack.

Electronic trading growth creates a virtuous cycle. More liquidity providers create deeper markets, attracting more liquidity takers, which in turn attracts more liquidity providers. Over time, as the liquidity gets deeper, the market participants become more diverse—large dealers, market makers, asset managers, hedge funds, and more. This means traders can access better prices, reduce opportunity costs and foster competition among price makers. All this while automating the previously manual process of handling phone calls and chat messages.

Global Convertible Bond Investors Utilizing Electronic Trading

The Better Execution Catalyst

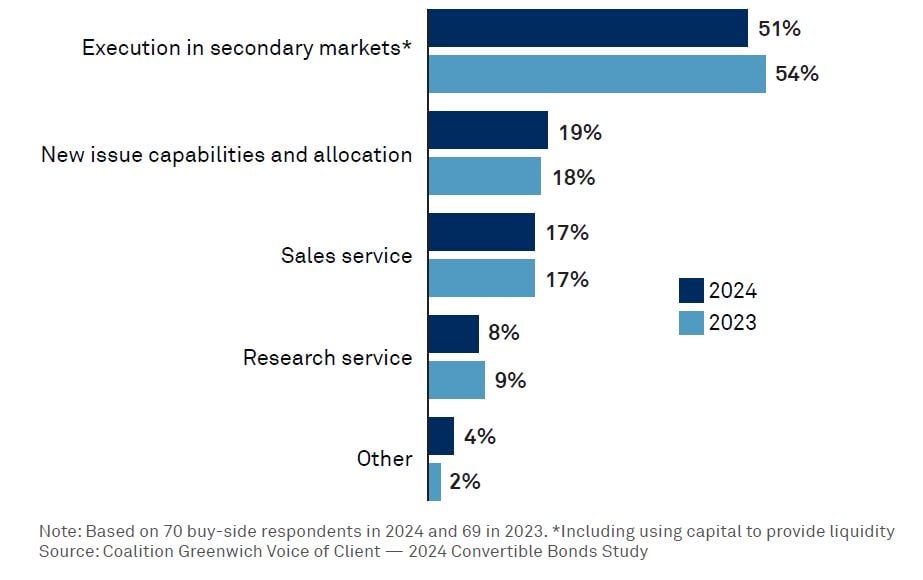

Over half of convertible bond investors participating in our study said that execution performance in the secondary markets is the key driver in allocating flow. Across asset classes, higher volumes and larger trade sizes generally lead to better execution quality with lower costs, and the U.S. convertible market is no different. Data from Tradeweb shows the average spread (an easy proxy for liquidity and implicit trading costs) in U.S. convertible bonds on its platform tightened by 50%, falling from almost 80 bps in 2022 to under 40 bps in the first half of 2024. The growing liquidity pool, increased competition between dealers, and an increase in hedge fund participants are contributing to increasingly tighter spreads. Lastly, more convertible bond issuance in recent years, $90 billion in 2023, has led to larger dealer inventories. Dealer bond holdings come with capital costs, which are always a strong motivator to get them off their books. Dealers are in the moving—not the storage—business.

Weighting of Key Drivers in Allocating Secondary U.S. Convertibles Volume

Changing regulations have also played a part in the adoption of MDPs. While MiFID wasn’t the sole driver among European investors (language and geographic diversity have long played a part), its provisions and the resulting changes in market structure and investor behavior contributed to an environment that favored MDPs. The emphasis on best execution forced firms to demonstrate that they had taken all reasonable steps to obtain the best possible result for their clients. MDPs, which allow investors to access multiple dealers and liquidity sources at once, providing a more comprehensive view of the market, were seen to help achieve best execution.

While U.S. firms don’t have to follow MiFID guidelines, a similar emphasis on achieving best execution through better performance and efficiencies has taken hold of this market as well. As in Europe, MDPs in the U.S. provide a centralized platform for investors to access multiple dealers and compare prices, increasing competition and driving down costs. Firms are thinking about MDPs as workflow solutions, particularly in today’s world of T+1 settlement with talk of straight-through processing (STP). Given the U.S. convertible bond market’s relative maturity, liquidity and established investor base, MDPs are a natural progression of the convertible bond market’s electronification.

Bigger Orders, Better Execution

As convertible bond investors become more comfortable with electronic trading, they’re starting to place larger orders. This trend in the convertible bond market reflects what we have already seen in the corporate bond market, where buy-side participants in a 2023 Coalition Greenwich study noted that nearly half of their orders were over $2 million in size—an increasingly high percentage of which were executed electronically. It’s a natural progression: Traders start with smaller, lower-value orders (often called “exhaust flow” or “odd lots”) and then move the dial up to bigger, more complex trades, often with a more targeted approach to a reduced number of dealers.

Data from Tradeweb shows that trades with notional values of $5 million and higher have grown by more than 45% year over year.

The shift toward larger, more difficult orders is led by several factors. With time and experience, buy-side traders become more comfortable sending complex flow to electronic platforms. As one trader told us, worries about information leakage and front-running in MDPs have been allayed with experience. In their view, only the winning dealer finds out the direction of the trade, so there’s less leakage compared to using chat rooms.

As performance, reliability and functionality gains are made, MDPs continue to demonstrate their increasing importance to the buy-side trader’s workflow as they navigate a mandate to do more with less. The platforms are enhancing their offerings with new functionalities to encourage new users and to keep existing ones engaged. Improved data access and enhancements in workflow efficiency tools like list trading and post-trade analytics are also catalysts for the buy side’s movement toward MDPs for larger trades.

Tradeweb U.S. Convertible Bonds

Benefits of STP via MDPs: Electronic Trading as a Workflow Solution

Electronic trading, particularly in less-liquid markets, provides benefits that go beyond improved execution quality.

Pre-trade transparency, real-time executable prices from multiple market makers and the ability to compare prices more systematically all come as part of the package. MDPs can also automate manual processes associated with convertible bond trading, such as trade capture, confirmation and settlement. The best ones will integrate easily with vendor-based and proprietary order management systems (OMSs), allowing for STP across the order life cycle.

Clients enter order instructions electronically on the order ticket, eliminating the need for dealers to manually enter data, reducing operational risk. From there, the order is automatically routed to multiple dealers for pricing based on instructions given. The client and winning dealer receive immediate electronic notification upon execution with trade details, reducing operational risk on both sides in today’s T+1 environment. This has been especially meaningful when trading lists, baskets or programs around client inflows/outflows, and rebalancing. One trader we spoke with noted, “The STP element cannot be overstated.” While this workflow is increasingly common in moreliquid parts of the bond market, its introduction to the convertible bond market is notable.

Some MDPs also offer advanced trading functionality, including multicurrency trading, complex trade execution and access to analytics and risk management tools. They provide real-time market data and analytics that are often unique to that platform, enabling clients to make more-informed trading decisions. Additionally, unlike negotiation via phone or chat, dealers in competive electronic auctions that MDPs provide tend to offer their best prices up front. This is reflected in spreads tightening by 50% on Tradeweb, as noted earlier.

While some dealers have been slower to embrace electronic trading for convertible bonds, perhaps fearing it will hurt client relationships and profitability, an increasing number now value the distribution and workflow efficiencies provided by electronic interactions. In other words, they too can scale their businesses and do more with less. As such, Tradeweb grew their dealer community from 12 quoting convertible bonds in 2020 to 22 doing so in 2024—an 83% increase in dealer participation.

Some dealers are integrating their internal trading systems with MDPs, using a “buy, build and integrate” approach. This hybrid model streamlines list trading by automating quoting and execution on MDPs, then flowing back to risk systems post-trade. This approach has been particularly effective, with list trading growing over 50% on Tradeweb since 2022. It enables dealers to quote baskets more efficiently, rather than individually quoting multiple names manually via phone or chat.

Looking Forward

Electronic trading in the bond market has seen strong growth since new capital rules out of the global financial crisis forced the buy side to seek liquidity in new ways. With government bond and corporate bond markets now trading half or more of their volume electronically, the market is looking to other fixed-income products that could benefit from the same efficiency boost.

Convertible bonds fit that bill nicely, and post-pandemic market dynamics have helped push the market structure forward as natural supply and demand has left dealers and investors alike looking for better ways to examine and tap into this market. Convertible bond traders have seen the tools their colleagues are using on the corporate bond desk—automation, pre-trade transparency, trade execution, compliance, analytics, list trading—and are increasingly asking for the same.

Couple that with dealers looking to inject efficiency and cost reductions into their convertible trading operation, and the outcome is obvious. Fixed-income markets have proven that even less-liquid products can be traded electronically when market participants have the right incentives and tools. Convertible bond markets have reached that inflection point.